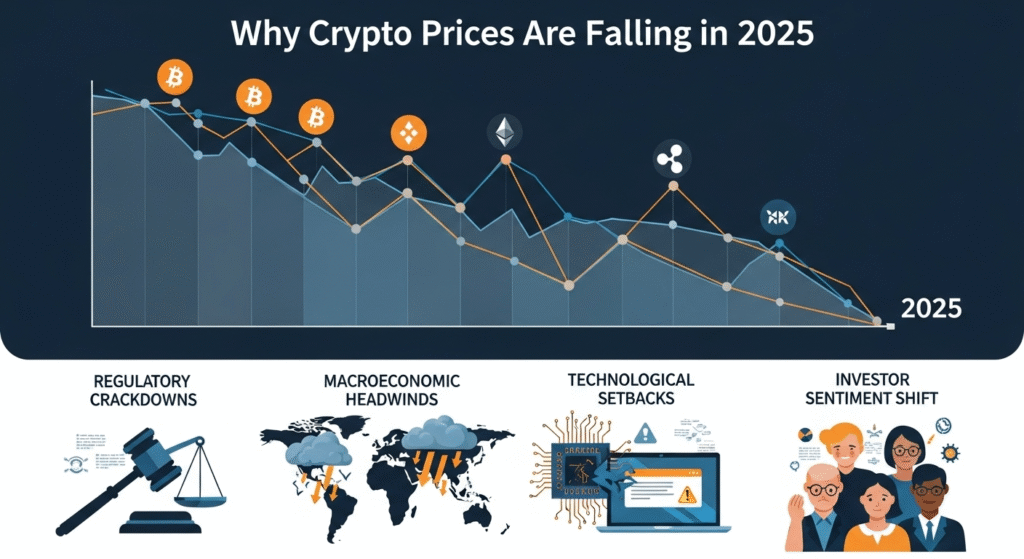

Crypto markets have seen sharp drops lately. Bitcoin fell from over $126,000 to around $92,000. Many altcoins lost even more value. Research suggests several factors at play. It seems likely that leverage and trade tensions caused much of the pain. Evidence leans toward a possible bear market, but some see it as a short-term dip. Controversy exists around whether this is a cycle repeat or something new due to big players.

Main Reasons for the Drop

- Trade tensions between the US and China sparked fear.

- High leverage led to huge liquidations.

- Fed policy changes reduced market hope.

- Tech stocks fell, pulling crypto down too.

- Bad sentiment made sellers rush out.

How This Affects Investors

Many people lost money fast. Liquidations hit a record $19 billion in one day. If you hold crypto, watch for signs of recovery. Check tools like the Fear and Greed Index. It shows extreme fear now.

What to Do Next

Stay calm. Look at history. Past drops often led to gains later. Think about your risk level. For more tips, see our Bitcoin Guide.

Crypto prices dropped hard in late 2025. Bitcoin lost about 20% in a month. It went from a high of $126,000 in October to under $93,000 by mid-November. Altcoins like Ethereum, Solana, and Dogecoin fell even more. Ethereum dropped from $4,300 to below $3,600. Dogecoin lost up to 50% in a day at one point. Solana saw 40% losses in hours. The total market cap slid from over $4 trillion to around $3.1 trillion. This hurt many holders. But why did it happen? Let’s look at the details.

Key Factors Behind the Crypto Drop

Several things came together to push prices down. No single cause stands out. But combined, they created a storm.

Trade Tensions and Policy Shifts

US President Trump’s posts played a big role. He threatened 100% tariffs on China. This came after market close on a Friday. It scared investors. Stocks fell 3%. Crypto dropped more. China then limited rare earth exports. These materials matter for tech. The news led to quick sales. Broader trade war fears grew. They raised costs and slowed growth. Risk assets like crypto suffer first in such times.

High Leverage and Record Liquidations

Many traders used borrowed money. This amps up gains but also losses. When prices dipped, lenders called in loans. This forced sales. Over $19 billion in bets got wiped out. Most were long positions betting on rises. It was the biggest ever. Past events like FTX in 2022 saw less, around $1.6 billion. Now, with bigger markets, losses scale up. Exchanges like Binance saw heavy action. Thin trading in some coins made it worse. Prices mispriced fast.

Macroeconomic Pressures

The economy added pressure. Fed rate cut odds fell from 90% to 50% for December. Higher rates mean less cash for risks. Inflation data surprised high. Tech stocks like Nvidia and Tesla dropped. Crypto links to tech now. AI hype cooled. This pulled funds away. ETF outflows hit $1 billion in a day. They had brought in big money before. Now, they drain it.

Technical and Sentiment Signals

Charts show bad signs. Bitcoin had a death cross. This is when short-term averages cross below long ones. RSI hit low 30s, meaning oversold. Fear and Greed Index went to extreme fear at 14. Now it’s around 64, but still wary. Whales sold hundreds of thousands of BTC. About a third of supply is in loss. Long-to-short ratios fell below 0.9. Shorters won. Retail mood turned sour. Many chased highs, then got burned.

Historical Cycles and Market Patterns

Crypto follows patterns. The halving in April 2024 cut miner rewards. Past halvings led to booms, then busts. Miners sell at peaks. This time, big players like ETFs change things. But the four-year cycle may still hold. Pullbacks of 50% happened before. Some see this as a mid-cycle shakeout. Others fear a full bear market like 2018 or 2022.

Impact on Different Coins

Not all coins fared the same. Here’s a table of recent drops for top ones:

| Coin | Peak Price (Oct 2025) | Low Price (Nov 2025) | % Drop |

|---|---|---|---|

| Bitcoin | $126,000 | $92,513 | ~27% |

| Ethereum | $4,300 | $3,600 | ~16% |

| Solana | $220 | $183 | ~17% |

| Dogecoin | $0.38 | $0.19 | ~50% |

| XRP | $2.80 | $2.45 | ~12% |

| Cardano | $1.20 | $0.80 | ~33% |

Data from market trackers shows altcoins hit harder. Mid-caps bled double digits. Some like SUI fell 70%.

Common Questions from Searchers

People often ask these:

- Why is Bitcoin price dropping today?

- Is this a bear market for crypto?

- What caused the 2025 crypto crash?

- Will crypto recover soon?

- How do tariffs affect crypto?

Related terms include: Bitcoin crash 2025, crypto bear market signs, liquidations explained, Fed impact on crypto.

Signs of a Possible Bottom

Some positive notes exist. Large wallets buy dips. History shows capitulation leads to turns. The index dipped to extreme fear, a buy signal before. But risks remain. Watch for Fed news or trade talks.

Strategies for Holders

- Hold long-term if you believe in crypto.

- Use dollar-cost averaging to buy low.

- Cut leverage to avoid wipes.

- Check our Crypto News for updates.

- Diversify to stablecoins during fear.

Broader Industry Issues

Bad news like money laundering hurts trust. Exchanges moved dirty funds. This adds to down pressure. North Korean hacks and scams rose. FBI says $9.3 billion lost in 2024. Regulators may tighten. But Trump eased some rules. Pardons for leaders like CZ show mixed signals.

Comparison to Past Crashes

Here’s a table comparing 2025 to prior drops:

| Year | Trigger | Bitcoin Drop | Recovery Time |

|---|---|---|---|

| 2018 | ICO bust, regulation | ~84% | 3 years |

| 2020 | COVID lockdowns | ~50% | 6 months |

| 2022 | FTX collapse, inflation | ~75% | 2 years |

| 2025 | Tariffs, leverage | ~27% so far | Ongoing |

Past events show recovery, but each is unique.

Final Thoughts

Crypto stays volatile. This drop tests holders. But it may clear weak hands. Watch key levels like $80,000 for Bitcoin. Stay informed. Markets can turn fast.