Cryptocurrency markets are known for their ups and downs. Bull runs, periods of rapid price growth, excite investors worldwide. As we move through 2025, many ask: when will the next crypto bull run happen? This post explores expert predictions, historical trends, market conditions, key drivers, risks, and practical strategies for navigating the potential surge. Whether you’re new to crypto or a seasoned investor, this guide offers clear, actionable insights.

What Is a Crypto Bull Run?

A crypto bull run is when cryptocurrency prices rise significantly over time. These surges often stem from:

- Positive News: Regulatory approvals or major investments.

- Market Sentiment: Growing investor optimism.

- Technological Advancements: New blockchain features.

- Adoption: More people and businesses using crypto.

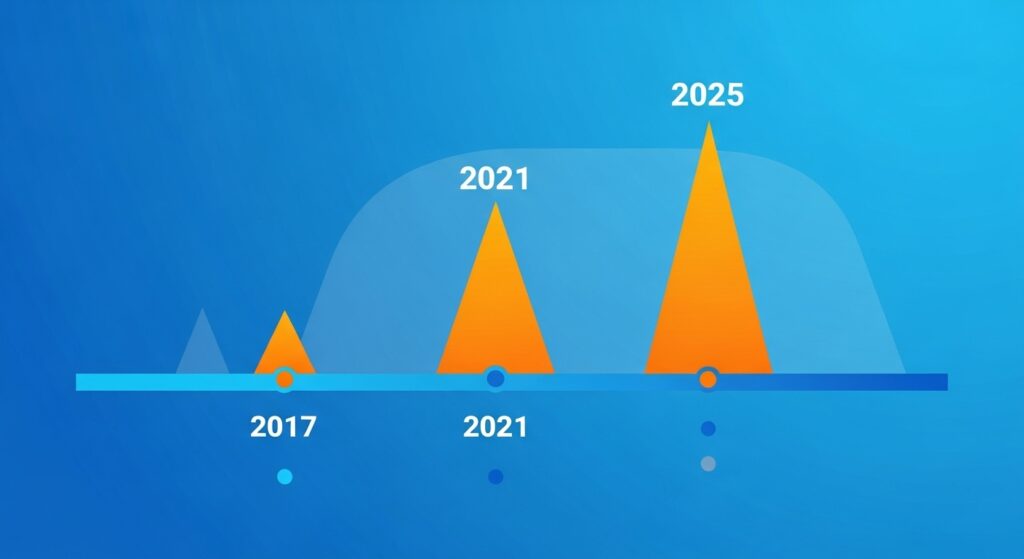

Historically, bull runs occur roughly every four years, often tied to Bitcoin’s halving events, which reduce the supply of new coins. For example:

- 2017 Bull Run: Bitcoin hit nearly $20,000, driven by retail enthusiasm.

- 2021 Bull Run: Bitcoin reached $69,000, with altcoins like Ethereum and Solana soaring.

These cycles feature rising confidence, media coverage, and new market participants.

Current State of the Crypto Market (2025)

As of August 2025, the crypto market shows signs of a potential bull run:

- Bitcoin’s Performance: Bitcoin has crossed $100,000, with a high of $109,241 in January 2025.

- Total Market Cap: The crypto market is valued at approximately $3.82 trillion, reflecting strong growth.

- Sentiment: The Fear & Greed Index is at 34 (fear), indicating caution despite recent gains.

The market has grown since early 2025, but some analysts warn of a possible correction before a sustained bull run.

Market Snapshot (Mid-2025)

| Metric | Value |

|---|---|

| Bitcoin Price | ~$95,000–$100,000 |

| Total Market Cap | ~$3.82 trillion |

| Fear & Greed Index | 34 (Fear) |

| Bitcoin Dominance | ~56% |

Curious if the bull run is over? Check out Is the Crypto Bull Run Over?

Predictions for the Next Bull Run

Experts offer varied timelines for the next bull run’s peak:

- TokenMetrics: Predicts the bull run began around April 2024 (post-halving) and could peak between March and November 2026, with Bitcoin at $150,000.

- CoinCodex: Suggests a peak in late 2025, with Bitcoin possibly reaching $175,000.

- Mudrex: Some analysts predict Bitcoin could hit $250,000, driven by the 2024 halving.

- Galaxy Digital: Forecasts Bitcoin exceeding $150,000 in early 2025, potentially reaching $185,000 by year-end.

Posts on X show speculative optimism, with some users predicting Bitcoin prices as high as $450,000 and altcoins surging 100–200x. These claims are often unverified and should be approached cautiously.

Predicted Bitcoin Price Targets

| Source | Predicted Price (USD) | Peak Timeline |

|---|---|---|

| TokenMetrics | $150,000 | Mar–Nov 2026 |

| Mudrex | $250,000 | 2025 |

| Galaxy Digital | $150,000–$185,000 | 2025 |

Key Drivers of the Bull Run

Several factors are likely to fuel the next bull run:

- Institutional Adoption:

- Bitcoin ETFs, approved in January 2024, have attracted $17.3 billion in inflows, boosting demand.

- Firms like BlackRock and J.P. Morgan are tokenizing real-world assets, bridging traditional finance and crypto.

- Technological Advancements:

- Bitcoin Ordinals and BRC-20 tokens expand Bitcoin’s use cases.

- AI integration with blockchain, like AI agents and onchain economies, is a growing trend.

- Macroeconomic Factors:

- U.S. interest rates at 4.19% make riskier assets like crypto appealing.

- The proposed Bitcoin Act could encourage market growth.

Emerging Trends

| Trend | Description |

|---|---|

| Bitcoin Ordinals | NFTs minted on Bitcoin’s blockchain. |

| BRC-20 Tokens | Fungible tokens on Bitcoin, boosting utility. |

| AI Agents | Onchain AI economies driving new use cases. |

| Real-World Asset Tokenization | Institutional adoption of blockchain for assets. |

Source: Forbes

Want to understand crypto market trends? Read Crypto Market Cap Explained.

Risks and Challenges

Despite optimism, risks could impact the bull run:

- Market Corrections: Pullbacks of 20–30% are common during bull runs.

- Regulatory Uncertainty: Global regulations could affect sentiment.

- Economic Conditions: Rising interest rates or fiscal policies may delay the peak.

Analysts like Ian Balina of TokenMetrics suggest the bull run may not peak until 2026 due to macroeconomic challenges. September has historically been Bitcoin’s weakest month, with an average 4.71% loss.

Potential Risks

| Risk | Impact |

|---|---|

| Market Correction | Temporary price drops during bull run. |

| Regulatory Changes | Could restrict or boost crypto adoption. |

| Economic Factors | Interest rates, tariffs may delay peak. |

Investment Strategies for the Bull Run

To navigate the next bull run, consider these strategies:

- Diversify Investments: Spread funds across Bitcoin, established altcoins (e.g., Ethereum, Solana), and promising new projects.

- Focus on Fundamentals: Invest in projects with active teams, real utility, and strong communities. AI, DeFi, and tokenization are key sectors.

- Manage Risk: Use stop-loss orders and only invest what you can afford to lose. Corrections are normal.

- Stay Informed: Follow market news and expert analyses. Platforms like TokenMetrics offer data-driven insights.

Altcoin Season Tips

- Monitor Bitcoin dominance (currently 56%). A drop below 50% often signals an altcoin season.

- Look for projects with strong narratives, like AI or tokenization.

- Expect corrections as healthy consolidation before further gains.

Learn about altcoins with Where and How to Buy Solana (SOL).

Conclusion

The next crypto bull run is a hot topic, with 2025 shaping up as a pivotal year. Experts predict a peak in late 2025 or 2026, driven by institutional adoption, technological advancements, and favorable economic conditions. However, risks like corrections and regulatory changes remain. By diversifying, researching, and managing risks, investors can position themselves for potential gains. Stay informed, invest responsibly, and watch market trends to make the most of this period.