Cryptocurrencies are known for their wild price swings, leaving many investors and enthusiasts wondering: what makes crypto go up? As of August 2025, the crypto market is experiencing another surge, driven by a mix of economic, political, and technological factors. In this guide, we’ll break down the key drivers of cryptocurrency price movements, helping you understand why prices rise and how to navigate this volatile market.

The Basics: Supply and Demand

At its core, cryptocurrency prices are governed by the same economic principle that drives all markets: supply and demand. When demand for a cryptocurrency increases while its supply remains limited, prices tend to rise. Conversely, if supply outpaces demand, prices fall.

- Supply: Many cryptocurrencies, like Bitcoin, have a fixed supply (e.g., Bitcoin’s cap of 21 million coins). This scarcity can drive prices up as demand grows. Other cryptocurrencies may have no supply limit, which can lead to inflation if new coins are created faster than demand increases.

- Demand: Demand is fueled by investor interest, adoption by businesses and individuals, and speculative trading. For example, when a major company announces it will accept a cryptocurrency as payment, demand often spikes, pushing prices higher.

Investor Sentiment and Market Speculation

Cryptocurrency markets are heavily influenced by investor psychology. Fear of missing out (FOMO) can drive prices up as traders rush to buy, while fear, uncertainty, and doubt (FUD) can trigger sell-offs and crashes. Social media and online forums amplify these sentiments, spreading news and opinions rapidly.

Speculation also plays a significant role. Many investors buy cryptocurrencies not for their utility but in hopes of selling at a higher price later. This speculative behavior can create bubbles, where prices rise unsustainably before collapsing.

Learn more about market trends in our post on Crypto Market Cap Explained.

Regulatory News and Government Policies

Government regulations and policies have a profound impact on crypto prices. Positive developments, such as the approval of cryptocurrency ETFs or favorable tax policies, can boost investor confidence and drive prices up. Conversely, crackdowns or bans can lead to sharp declines.

A recent example is Donald Trump’s 2024 U.S. presidential election victory. Trump’s pro-crypto stance, including promises to appoint a crypto-friendly SEC chair and oppose a Federal Reserve digital currency, has fueled the current bull run. His policies have created a more favorable environment for cryptocurrencies, increasing investor confidence.

Navigate regulations with our guide on What is KYC in Crypto?.

Macroeconomic Factors

Cryptocurrencies are not isolated from the broader economy. During economic uncertainty, such as recessions or high inflation, some investors turn to cryptocurrencies as a hedge, similar to gold. This increased demand can drive prices up.

However, when traditional markets perform well, investors may shift away from riskier assets like crypto, potentially lowering demand and prices. Understanding these macroeconomic trends is crucial for predicting crypto price movements.

Curious about market cycles? Check out Will Crypto Recover?.

Technological Advancements and Utility

The value of a cryptocurrency often depends on its technology and real-world use. Cryptocurrencies that offer innovative solutions—such as faster transactions, lower fees, or unique applications like smart contracts (e.g., Ethereum)—tend to attract more investment.

For instance, when a cryptocurrency gains widespread adoption for payments or is integrated into popular platforms, its demand increases, pushing prices higher. Technological breakthroughs or upgrades can also spark price rallies.

Political Events and Global News

Political events and global news can have immediate and dramatic effects on crypto prices. Elections, geopolitical tensions, and international agreements can all influence investor behavior.

As mentioned, Trump’s election has been a significant catalyst for the recent crypto surge. Similarly, past events like Brexit or trade wars have impacted financial markets, including cryptocurrencies. Staying informed about global news is essential for understanding potential price triggers.

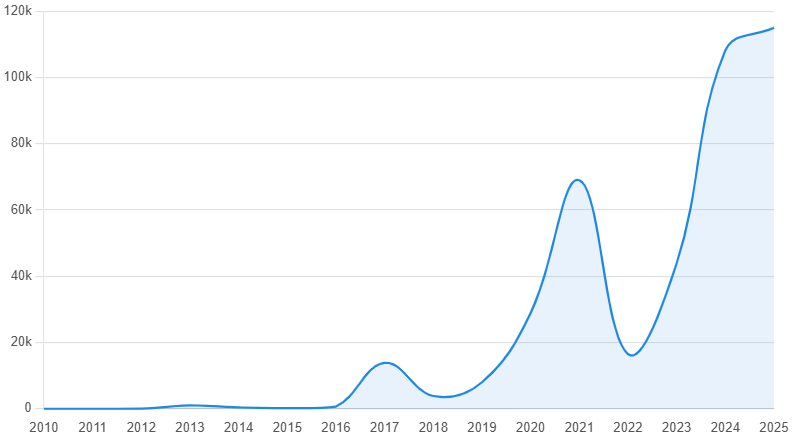

Why Is Crypto Going Up Right Now?

As of August 2025, several factors are contributing to the current crypto surge:

- Trump’s Pro-Crypto Policies: His administration’s supportive stance, including plans for a crypto-friendly SEC chair and opposition to a Federal Reserve digital currency, has boosted investor confidence.

- Global Economic Uncertainty: With ongoing economic challenges, investors are turning to cryptocurrencies as a hedge against inflation and currency devaluation.

- Increased Adoption: More businesses and institutions are integrating cryptocurrencies into their operations, increasing demand.

- Technological Innovations: Ongoing developments in blockchain technology are making cryptocurrencies more practical and appealing.

Can You Predict Crypto Price Movements?

Predicting crypto prices is notoriously difficult due to their volatility. However, by monitoring the factors outlined above—supply and demand, investor sentiment, regulations, macroeconomic conditions, technology, and global news—you can make more informed decisions. Tools like market analysis platforms (e.g., CoinMarketCap) and staying updated on news can help.

Is Now a Good Time to Invest in Crypto?

The answer depends on your risk tolerance and investment goals. Crypto markets are highly volatile, offering both significant opportunities and risks. If you’re considering investing, do thorough research, diversify your portfolio, and only invest what you can afford to lose.

Want to explore investment options? Read about What is a Crypto ETF?.

The Future of Cryptocurrency

Cryptocurrencies are here to stay, but their future remains uncertain. As adoption grows and regulations evolve, we may see more stability. However, the market will likely continue to experience significant fluctuations. Staying informed and adaptable is key.

Conclusion

What makes crypto go up? It’s a combination of supply and demand, investor sentiment, regulatory news, macroeconomic factors, technological advancements, and political events. Understanding these drivers can help you navigate the crypto market more effectively. Whether you’re a seasoned trader or a curious beginner, keeping an eye on these factors is essential for making informed decisions.

Key Factors Table

| Factor | Impact on Crypto Prices |

|---|---|

| Supply and Demand | Limited supply with high demand increases prices; oversupply can lower them. |

| Investor Sentiment | Positive sentiment (FOMO) drives buying; negative sentiment (FUD) triggers sell-offs. |

| Regulatory News | Favorable policies boost confidence; restrictions cause declines. |

| Macroeconomic Conditions | Economic uncertainty can increase demand; strong traditional markets may reduce it. |

| Technological Advancements | Innovative features or adoption increase value; outdated tech may lower interest. |

| Political Events | Elections or global news can sway investor behavior, impacting prices. |