Introduction to HBAR and Hedera Hashgraph

HBAR is the native cryptocurrency of the Hedera Hashgraph platform, a decentralized public ledger designed for fast, secure, and energy-efficient transactions. As of August 5, 2025, HBAR’s price is around $0.24467 USD, per CoinMarketCap. Unlike Bitcoin or Ethereum, which use blockchain, Hedera uses a unique technology called Hashgraph. This enables high-speed transactions and low fees, making HBAR ideal for developers and businesses. HBAR is used for transaction fees, payments, and staking to secure the network. However, its governance by a council of companies like Google and IBM may raise centralization concerns for some users. This guide covers HBAR’s features, uses, and how to get started.

Understanding the Hedera Hashgraph Platform

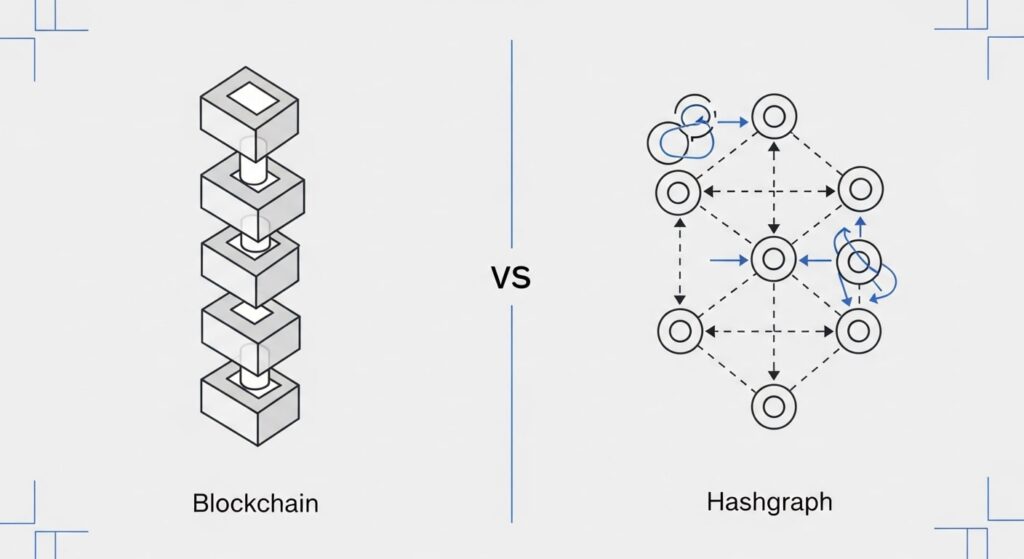

Hedera Hashgraph is a decentralized ledger that uses the Hashgraph consensus algorithm, not blockchain. Hashgraph organizes data in a directed acyclic graph (DAG), where transactions are linked directly. This allows faster processing, better scalability, and enhanced security compared to traditional blockchains.

Key Features of Hedera

- High Speed: Processes over 10,000 transactions per second (TPS), compared to Bitcoin’s 7 TPS or Ethereum’s 30 TPS.

- Low Latency: Transactions finalize in 3-5 seconds.

- Low Fees: Average transaction fees are $0.0001, perfect for micropayments.

- Energy Efficiency: Uses 0.00017 kWh per transaction, far less than Bitcoin’s 885 kWh or Ethereum’s 102 kWh.

- Security: Employs asynchronous Byzantine Fault Tolerance (aBFT) for robust protection.

| Feature | Hedera (HBAR) | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|---|

| Transactions per Second | 10,000+ TPS | 7 TPS | 30 TPS |

| Transaction Fee | $0.0001 | $10+ | $0.68+ |

| Confirmation Time | 3-5 seconds | 10-60 minutes | 10-20 seconds |

| Energy per Transaction | 0.00017 kWh | 885 kWh | 102 kWh |

How Does HBAR Work?

HBAR powers the Hedera network by paying for services like:

- Transferring HBAR tokens

- Minting fungible tokens or NFTs

- Executing smart contracts

- Storing data

Each transaction uses HBAR to compensate consensus nodes for bandwidth, compute, and storage. Users can stake HBAR to nodes to help secure the network and earn up to 6.5% annual rewards. The total supply of 50 billion HBAR was pre-minted in 2018, with a 15-year release schedule managed by Hedera’s governing council.

Advantages of Hedera Over Other Cryptocurrencies

Hedera stands out for several reasons:

- Speed and Scalability: Handles over 10,000 TPS, outpacing most blockchains.

- Low Costs: Fees of $0.0001 make it ideal for frequent, small transactions.

- Eco-Friendly: Consumes minimal energy, appealing to environmentally conscious users.

- Enterprise Support: Backed by a governing council of major companies like Google, IBM, and Boeing, ensuring trust and stability.

Potential Drawbacks and Criticisms

Hedera has some challenges:

- Centralization Concerns: The governing council, with up to 39 enterprise members, may seem less decentralized than other cryptocurrencies.

- Market Volatility: HBAR’s price can fluctuate, as seen with a recent 130% rally followed by corrections.

- Regulatory Risks: Evolving crypto regulations could impact HBAR’s adoption.

Use Cases and Applications

HBAR and Hedera support various applications:

- Decentralized Apps (dApps): Used in DeFi, gaming, and NFT marketplaces.

- Micropayments: Low fees enable small, frequent payments.

- Tokenization: Supports creating fungible tokens and NFTs.

- Enterprise Solutions: Used for supply chain tracking, identity verification, and CBDCs, with pilots like Australia’s Project Acacia.

Getting Started with HBAR

To begin using HBAR:

- Buy HBAR: Purchase on exchanges like Coinbase, Binance, or Kriptomat. Learn more at How to Buy Crypto Without KYC.

- Store HBAR: Use wallets like Ledger Nano, Atomic Wallet, or Trust Wallet.

- Stake HBAR: Stake to a node to earn rewards and support network security.

Future of HBAR and Hedera

Hedera’s future looks bright, with growing partnerships and use cases. Recent developments, like its listing on Robinhood and tokenized asset trials with Lloyds, signal strong adoption. Features like sharding will further boost scalability. HBAR’s role in CBDCs and enterprise solutions positions it as a leader in the decentralized economy. However, price predictions vary, with some analysts suggesting $0.53-$1 by 2025, though volatility remains a factor.

Frequently Asked Questions (FAQs)

- What is HBAR?

HBAR is the native token of Hedera Hashgraph, used for fees, payments, and staking. - How does Hashgraph differ from blockchain?

Hashgraph uses a DAG structure for faster, more efficient transactions compared to blockchain’s sequential blocks. - Is HBAR a good investment?

HBAR’s value depends on market trends and adoption. Research thoroughly, as crypto is risky. See What is a Crypto ETF? for more investment insights. - How can I buy and store HBAR?

Buy on exchanges and store in wallets like Ledger Nano or Trust Wallet. - What are HBAR’s use cases?

HBAR supports dApps, micropayments, tokenization, and enterprise solutions like supply chain tracking. - Who governs Hedera?

A council of up to 39 enterprises, including Google, IBM, and Deutsche Telekom, oversees Hedera. - Is Hedera fully decentralized?

Hedera’s council governance raises some centralization concerns, though it plans to move to a permissionless system.

Conclusion

HBAR and Hedera Hashgraph offer a fast, efficient, and eco-friendly alternative to traditional blockchains. With support from major companies and growing use cases like CBDCs and tokenized assets, HBAR is a key player in the crypto space. However, its governance model and market volatility require careful consideration. Whether you’re a developer, investor, or crypto beginner, HBAR is worth exploring. For more on crypto trends, check out Is Crypto Mining Profitable? or What is a Crypto ETF?.