Cryptocurrencies like Bitcoin and Ethereum are popular, but investing in them can feel complex. Crypto ETFs make it easier by letting you invest through stock markets. This guide explains what crypto ETFs are, how they work, their benefits and risks, and how to start investing. We’ll also compare them to direct crypto investments and look at their future.

What is a Crypto ETF?

A crypto ETF is an Exchange-Traded Fund that tracks cryptocurrency prices, like Bitcoin or Ethereum. You can buy and sell it on stock exchanges, just like stocks. Instead of owning the cryptocurrency, you own shares in the ETF, which follows the crypto’s price movements. This means you don’t need a digital wallet or a crypto exchange account.

For example, a Bitcoin ETF moves with Bitcoin’s price. If Bitcoin rises, the ETF’s value rises too. This makes crypto investing simpler for beginners.

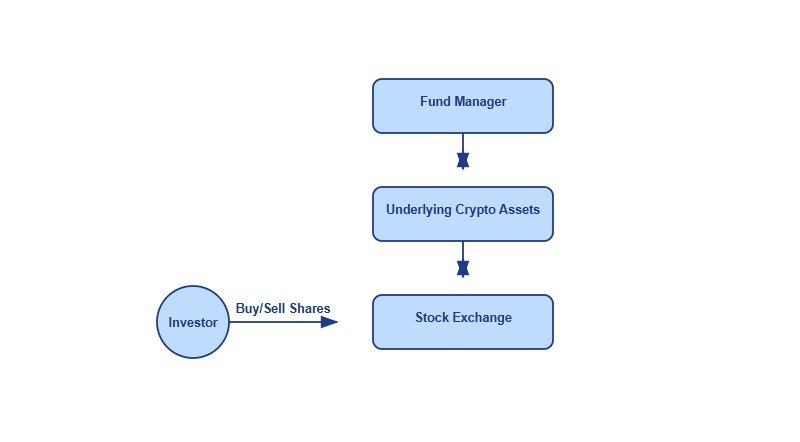

How Do Crypto ETFs Work?

Crypto ETFs hold cryptocurrencies or related financial instruments. There are two main types:

- Spot ETFs: These hold the actual cryptocurrency, like Bitcoin or Ethereum. Their price closely tracks the crypto’s market price.

- Futures ETFs: These invest in futures contracts, which are agreements to buy or sell crypto at a future date. They may not track prices as closely.

When you buy ETF shares, you invest in the fund, not the crypto itself. The ETF trades on exchanges like the NYSE, making it easy to buy through a brokerage account.

Types of Crypto ETFs

Crypto ETFs vary based on what they track:

- Spot Bitcoin ETFs: Hold Bitcoin directly, like iShares Bitcoin Trust (IBIT).

- Futures Bitcoin ETFs: Track Bitcoin futures contracts, like ProShares Bitcoin Strategy ETF (BITO).

- Ethereum ETFs: Track Ethereum’s price, either spot or futures-based.

- Blockchain ETFs: Invest in companies working on blockchain technology, like Global X Blockchain ETF (BKCH).

- Bitcoin Miner ETFs: Focus on Bitcoin mining companies, like Valkyrie Bitcoin Miners ETF (WGMI).

| Type | Description | Example |

|---|---|---|

| Spot Bitcoin ETFs | Hold actual Bitcoin | iShares Bitcoin Trust (IBIT) |

| Futures Bitcoin ETFs | Track Bitcoin futures contracts | ProShares Bitcoin Strategy ETF (BITO) |

| Ethereum ETFs | Track Ethereum’s price | Grayscale Ethereum Trust (ETHE) |

| Blockchain ETFs | Invest in blockchain companies | Global X Blockchain ETF (BKCH) |

| Bitcoin Miner ETFs | Focus on Bitcoin mining companies | Valkyrie Bitcoin Miners ETF (WGMI) |

Benefits of Crypto ETFs

Crypto ETFs have several advantages:

- Easy Access: Buy them through brokerage accounts like Fidelity or Schwab, no crypto wallet needed.

- Diversification: Some ETFs hold multiple assets, reducing risk.

- Liquidity: Trade shares easily during stock market hours.

- Lower Risk: ETFs manage crypto security, avoiding risks like hacks or lost keys.

For example, the iShares Bitcoin Trust (IBIT) lets you invest in Bitcoin without worrying about storing it safely.

Risks of Crypto ETFs

Crypto ETFs come with risks:

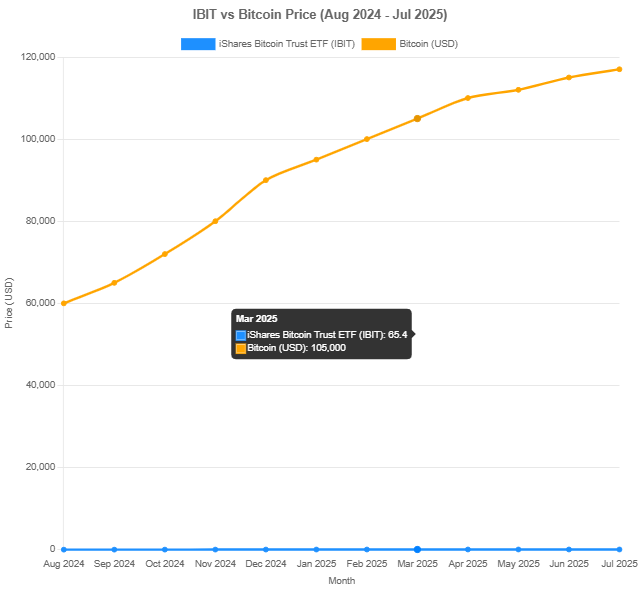

- Volatility: Crypto prices can swing wildly. Bitcoin hit $120,551 in July 2025 but has dropped sharply before.

- Fees: ETFs charge expense ratios, often higher than traditional ETFs. For example, BITO’s expense ratio is 0.95%.

- Tracking Errors: Futures ETFs may not match crypto prices perfectly.

- Regulation: The crypto market’s rules are still developing, which adds uncertainty.

Always consider these risks and talk to a financial advisor before investing.

How to Invest in Crypto ETFs

Investing in crypto ETFs is simple:

- Open a Brokerage Account: Use platforms like E*TRADE or TD Ameritrade.

- Add Funds: Deposit money into your account.

- Choose an ETF: Look for ETFs like IBIT or BITO by their ticker symbols.

- Buy Shares: Purchase through your brokerage platform.

Check the ETF’s fees and performance. For instance, IBIT has a low 0.25% expense ratio, making it cost-effective.

Popular Crypto ETFs in 2025

Here are some top crypto ETFs as of July 2025:

- iShares Bitcoin Trust ETF (IBIT): A spot Bitcoin ETF with $87.95 billion in assets and a 0.25% expense ratio.

- Grayscale Bitcoin Mini Trust ETF (BTC): A spot Bitcoin ETF launched in July 2024, holding 45,722 Bitcoins with a 0.15% expense ratio.

- ProShares Bitcoin Strategy ETF (BITO): A futures-based ETF with a 0.95% expense ratio and monthly income distributions.

- Global X Blockchain ETF (BKCH): Tracks blockchain companies with a 0.50% expense ratio.

- Valkyrie Bitcoin Miners ETF (WGMI): Focuses on Bitcoin mining firms with a 0.75% expense ratio.

| ETF Name | Ticker | Type | Expense Ratio | Assets Under Management |

|---|---|---|---|---|

| iShares Bitcoin Trust ETF | IBIT | Spot Bitcoin | 0.25% | $87.95 billion |

| Grayscale Bitcoin Mini Trust ETF | BTC | Spot Bitcoin | 0.15% | $4.6 billion |

| ProShares Bitcoin Strategy ETF | BITO | Futures Bitcoin | 0.95% | $2.5 billion |

| Global X Blockchain ETF | BKCH | Blockchain | 0.50% | $146.8 million |

| Valkyrie Bitcoin Miners ETF | WGMI | Bitcoin Miners | 0.75% | Not specified |

Crypto ETFs vs. Direct Crypto Investment

Crypto ETFs and direct crypto investments have different pros and cons:

- Crypto ETFs:

- Pros: Easy to trade, SEC-regulated, no wallet needed, can be held in IRAs.

- Cons: Higher fees, possible tracking errors, no direct crypto ownership.

- Direct Crypto Investment:

- Pros: Full control, lower fees, 24/7 trading on exchanges.

- Cons: Risk of hacks, complex wallet management, less regulation.

Beginners may prefer ETFs for simplicity, while experienced investors might choose direct ownership for control. Learn more about crypto management in our guide on How to Buy Crypto Without KYC.

The Future of Crypto ETFs

Crypto ETFs are growing fast. The SEC approved spot Bitcoin ETFs in January 2024, leading to $65 billion in inflows. Ethereum spot ETFs followed in July 2024. Bitcoin’s price hit $120,551 in July 2025, driven by institutional interest and crypto-friendly policies under the Trump administration.

New ETFs for altcoins like Solana, XRP, and Dogecoin are under review, with approvals possible in 2025 or 2026. This could make crypto ETFs a mainstream investment, but volatility remains a risk.

Are Crypto ETFs Safe?

Crypto ETFs are regulated by the SEC, offering more security than direct crypto ownership. However, they’re still tied to volatile crypto markets, and risks like tracking errors or regulatory changes exist. Always assess your risk tolerance.

Do Crypto ETFs Pay Dividends?

Some ETFs, like the Roundhill Bitcoin Covered Call Strategy ETF (YBTC), generate income through strategies like covered calls. Most focus on price growth, not dividends.

Can You Buy Crypto ETFs in an IRA?

Yes, ETFs like IBIT and BITO can be held in Roth IRAs, making them appealing for retirement planning.

Conclusion

Crypto ETFs are a simple way to invest in cryptocurrencies without the hassle of direct ownership. They offer easy access, diversification, and liquidity but carry risks like volatility and fees. With SEC approvals and growing interest, crypto ETFs are gaining traction. Research carefully and consider your goals before investing.

For more crypto insights, visit: