A crypto bull run is a period when cryptocurrency prices rise steadily for weeks or months. It’s driven by high demand, low supply, and growing investor confidence. This guide explains what a bull run is, its causes, phases, historical examples, and how to prepare for the next one in 2025. Whether you’re new to crypto or an experienced investor, this post will help you understand and navigate the market.

What Is a Crypto Bull Run?

A crypto bull run is when cryptocurrency prices increase significantly over a prolonged period. It’s the opposite of a bear market, where prices fall. During a bull run, investors are optimistic, demand for crypto surges, and prices climb rapidly. Bitcoin often leads the charge, followed by Ethereum and altcoins.

Key Features of a Bull Run

- Rising Prices: Cryptocurrencies like Bitcoin and Ethereum hit new highs.

- High Trading Volume: More people buy, increasing market activity.

- Investor Confidence: Optimism fuels demand, attracting new investors.

- Media Attention: News outlets and social media amplify the hype.

What Causes a Crypto Bull Run?

Several factors spark and sustain a crypto bull run. Understanding these can help you spot one early.

Main Triggers

- Bitcoin Halving: Every four years, Bitcoin’s mining reward halves, reducing supply and often pushing prices up. The 2024 halving sparked the current bull run.

- Institutional Investment: Big players like ETFs and corporations buying crypto boost confidence and liquidity. For example, Bitcoin ETFs saw 51,500 BTC inflows in December 2024.

- Regulatory Support: Crypto-friendly policies, like the U.S. proposing a Bitcoin reserve in 2025, drive optimism.

- Economic Conditions: Low interest rates or inflation fears push investors to crypto as a hedge.

- Technological Advances: Improvements in blockchain, like Ethereum’s upgrades, attract new users.

- Media and Social Hype: Rising Google searches for “Bitcoin price” or trending hashtags signal growing interest.

Learn more about what makes crypto prices go up to understand market drivers.

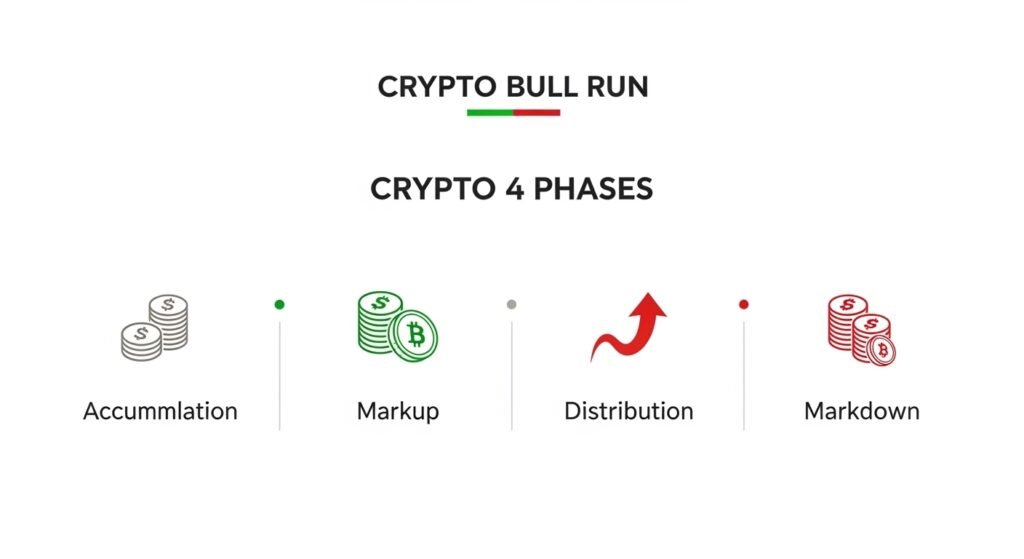

Phases of a Crypto Bull Run

Crypto bull runs follow a cycle with distinct phases. Knowing these helps you time your investments.

1. Accumulation Phase

- Prices are low after a bear market.

- Smart investors buy at discounted rates.

- Market sentiment is cautious but improving.

2. Markup Phase

- Prices rise steadily as demand grows.

- Bitcoin often leads, followed by Ethereum and altcoins.

- Media coverage and trading volume spike.

3. Distribution Phase

- Prices peak and stabilize.

- Experienced investors start selling to lock in profits.

- New investors enter, driven by FOMO (fear of missing out).

4. Markdown Phase

- Prices drop as the bull run ends.

- Investors panic-sell, leading to a bear market.

Check out when is the next crypto bull run for predictions on future cycles.

Historical Crypto Bull Runs

Looking at past bull runs helps predict future trends. Here are key examples:

2013 Bull Run

- Bitcoin rose from $13 to over $1,000.

- Trigger: Cyprus banking crisis and growing adoption.

- Correction: Prices crashed by 80% in 2014.

2017 Bull Run

- Bitcoin hit $20,000, driven by retail investors and ICO hype.

- Altcoins surged, but many crashed in 2018.

- Correction: Bitcoin fell to $3,323 by December 2018.

2020-2021 Bull Run

- Bitcoin soared from $8,000 to $64,000.

- Triggers: COVID-19 stimulus, DeFi boom, and institutional investment.

- Correction: Prices dropped 50%+ in 2022.

2024-2025 Bull Run

- Bitcoin hit $122,379 in July 2025, driven by ETF inflows and regulatory support.

- Ethereum gained 25.6% in a week, supported by institutional staking.

- Analysts predict Bitcoin could reach $150,000-$250,000 by year-end.

How to Prepare for a Crypto Bull Run

To make the most of a bull run, follow these practical steps:

1. Research Thoroughly

- Study a crypto’s fundamentals, like its technology and team.

- Use tools like CoinGecko or CoinMarketCap for data.

- Avoid hype-driven investments based on FOMO.

2. Diversify Your Portfolio

- Invest in Bitcoin and Ethereum for stability.

- Allocate a small portion to promising altcoins.

- Spread risk across different sectors, like DeFi or AI tokens.

Learn how to start investing in cryptocurrency for beginner tips.

3. Use Dollar-Cost Averaging (DCA)

- Invest a fixed amount regularly, regardless of price.

- This reduces the risk of buying at a peak.

- Example: Buy $100 of Bitcoin weekly to average your cost.

Read more about what is DCA in crypto for a detailed guide.

4. Set Exit Points

- Decide when to sell (e.g., at a 50% gain).

- Use stop-loss orders to protect against sudden drops.

- Take profits gradually to avoid missing the peak.

5. Stay Safe

- Use secure wallets like Tangem to store your crypto.

- Beware of scams and phishing during bull runs.

- Enable two-factor authentication on exchanges.

Discover how to buy crypto with Tangem wallet for secure storage tips.

Risks to Watch Out For

Bull runs are thrilling but risky. Here’s what to avoid:

- FOMO: Don’t buy at peaks due to hype.

- Market Corrections: Prices can drop 10-20% even in a bull run.

- Scams: Hackers target investors during bull runs.

- Overtrading: Frequent trades can lead to high fees and losses.

Learn about FUD in crypto to avoid panic-driven decisions.

When Will the Next Bull Run Happen?

As of August 2025, the crypto market is in a bull run, with Bitcoin at $118,000 and analysts predicting $150,000-$250,000 by year-end. The peak may occur between April and November 2026, depending on market trends. Watch for:

- Bitcoin breaking $122,000 with high volume.

- Increased altcoin activity, especially meme coins.

- Regulatory updates, like the U.S. Bitcoin reserve plan.

Read is the crypto bull run over for insights on the current cycle.

Frequently Asked Questions

How Long Does a Crypto Bull Run Last?

Bull runs typically last 12-18 months, followed by a correction.

Can Altcoins Outperform Bitcoin in a Bull Run?

Yes, altcoins often see higher percentage gains but carry more risk.

How Do I Spot a Bull Run Early?

Look for rising prices, high trading volume, and positive news like ETF approvals.

Is It Too Late to Invest in a Bull Run?

It’s not too late if you buy during dips and use DCA. Avoid buying at peaks.

Conclusion

A crypto bull run is a period of rising prices driven by demand, confidence, and external factors like Bitcoin halving or institutional investment. By understanding its phases, triggers, and risks, you can make informed decisions. Research thoroughly, diversify, use DCA, and set exit points to maximize gains. Stay vigilant for scams and market corrections. The 2025 bull run offers opportunities, but preparation is key.

Start your crypto journey with how to buy crypto without KYC for private trading tips.