Cryptocurrency offers ways to earn passive income, and staking and delegating are two popular methods. While related, they are not the same. This guide explains their differences, benefits, risks, and how to get started. Whether you’re new to crypto or an experienced investor, this article will help you choose the best method to grow your assets.

What Is Crypto Staking?

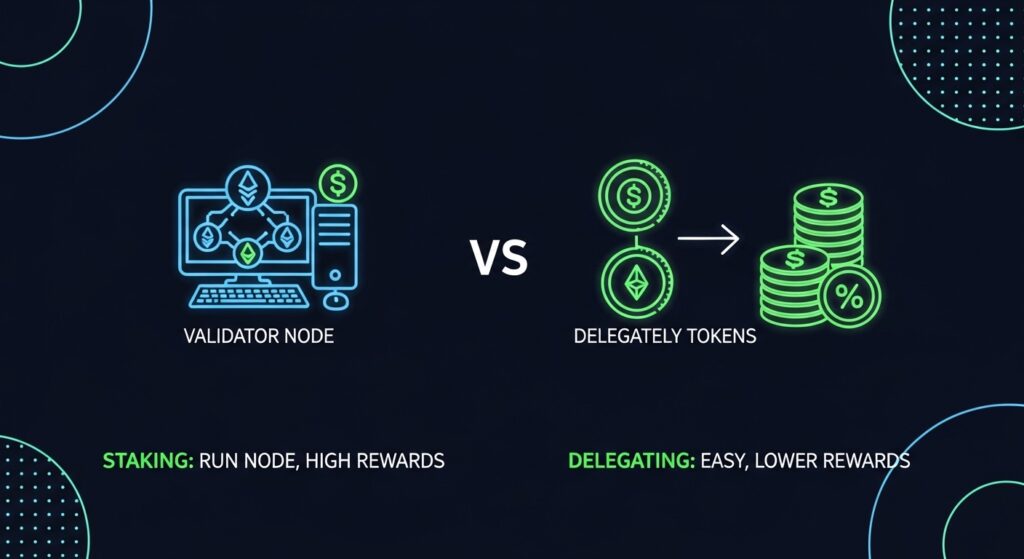

Staking means locking up your cryptocurrency to support a blockchain’s operations and security. In return, you earn rewards, usually in the same cryptocurrency. Staking is used in Proof-of-Stake (PoS) blockchains like Ethereum or Cardano, which are more energy-efficient than Proof-of-Work blockchains like Bitcoin.

How Staking Works

- Role of Stakers: You lock crypto in a wallet or smart contract to help validate transactions.

- Validator Selection: The more crypto you stake, the better your chance to validate transactions and earn rewards.

- Network Security: Staking keeps the blockchain secure by encouraging honest behavior. Dishonest validators risk losing their stake (slashing).

Benefits of Staking

- Earn passive income without trading.

- Support blockchain security and operations.

- More eco-friendly than mining.

Risks of Staking

- Lockup Periods: Staked crypto may be locked for days or weeks.

- Slashing Risk: Rare, but validator errors or misbehavior can lead to losses.

- Market Volatility: Your staked crypto’s value can drop.

What Is Crypto Delegating?

Delegating is a type of staking where you assign your crypto to a validator who handles the technical work. You earn a share of their rewards, minus a fee. It’s ideal for those without the skills or resources to run a validator node.

How Delegating Works

- Role of Delegators: You give your crypto to a validator to stake on your behalf.

- Validator Duties: Validators process transactions and create blocks, sharing rewards with you.

- Fees: Validators charge a commission (e.g., 5-20%) for their services.

Benefits of Delegating

- Easy to start, no technical skills needed.

- Low entry point, often requiring less crypto than staking.

- Earn rewards while supporting the network.

Risks of Delegating

- Validator Dependence: Rewards depend on the validator’s reliability. Poor performance or misbehavior can reduce earnings or lead to slashing.

- Fees: Commissions cut into your rewards.

- Market Volatility: Your delegated crypto’s value can fluctuate.

Key Differences Between Staking and Delegating

| Aspect | Staking (Validator) | Delegating |

|---|---|---|

| Participation | Direct: Run a validator node | Indirect: Assign crypto to a validator |

| Technical Skills | High: Requires hardware and expertise | Low: No setup needed |

| Control | Full control over staking process | Limited control, relies on validator |

| Rewards | Higher, no commission fees | Lower, after validator fees |

| Risks | Slashing, technical issues, high capital | Validator reliability, fees, slashing risk |

How to Get Started with Staking or Delegating

- Pick a Blockchain: Choose a PoS cryptocurrency like Ethereum (ETH), Cardano (ADA), or Solana (SOL). Each has different staking rules and rewards.

- Set Up a Wallet: Use a wallet that supports staking, such as:

- Daedalus for Cardano

- Exodus for multiple cryptocurrencies

- Ledger for secure hardware wallets

- Stake or Delegate:

- Staking: Set up a validator node if you have the skills and resources.

- Delegating: Select a trusted validator or staking pool and delegate your tokens.

- Track Rewards: Monitor earnings using wallet dashboards or blockchain explorers like nearblocks.io.

Best Practices for Staking and Delegating

- Research Validators: Look for validators with:

- High uptime (99% or more)

- Low fees (avoid 0% fees, as they may not last)

- Good reputation (check nearblocks.io or community reviews)

- Diversify: Spread your stake across multiple validators to reduce risk, especially on networks like Cosmos.

- Understand Rules: Know lockup periods (e.g., 21 days on Cosmos), reward schedules, and unbonding times.

- Stay Updated: Follow blockchain news via official sites or forums to stay informed about changes.

Popular Blockchains for Staking and Delegating

| Blockchain | Native Token | Staking Method | Key Features |

|---|---|---|---|

| Ethereum | ETH | Staking/Delegating | Supports pools like Lido or Rocket Pool. |

| Cardano | ADA | Delegating | Delegate via Daedalus or Yoroi. |

| Solana | SOL | Staking/Delegating | High-speed; delegate via Solana Beach. |

| Tezos | XTZ | Delegating | Delegate to “bakers” via Baking Bad. |

| Cosmos | ATOM | Delegating | Diversify across validators for safety. |

Frequently Asked Questions (FAQs)

Can I Lose My Crypto While Staking or Delegating?

There’s a small risk of loss from validator misbehavior or network issues, but most PoS blockchains have safeguards to protect funds.

What Happens if My Validator Goes Offline?

You may miss rewards, but your tokens are usually safe. You can redelegate to another validator.

How Are Staking Rewards Calculated?

Rewards depend on:

- Amount staked

- Staking duration

- Network performance and inflation rate

Is Staking Available for All Cryptocurrencies?

No, only PoS blockchains like Ethereum, Cardano, and Solana support staking.

People Also Ask

- What is the best crypto to stake in 2025?

Popular choices include ETH, ADA, and SOL, based on rewards and network stability. - How do I pick a staking pool?

Choose pools with high uptime, low fees, and transparency. Use sites like Baking Bad for Tezos or Solana Beach for Solana. - Is staking crypto safe?

Staking is generally safe, but risks include volatility, validator issues, and rare slashing events. - What are staking rewards?

Rewards are extra tokens earned for staking or delegating, based on your stake and network rules.

Conclusion

Staking and delegating are great ways to earn passive income while supporting blockchain networks. Staking as a validator offers higher rewards but requires technical skills and resources. Delegating is easier, ideal for beginners, but depends on validator performance. Research validators, diversify your stake, and stay informed to maximize rewards and minimize risks. Visit Krypdrops.com for more crypto guides.