The cryptocurrency market is booming. Experts predict it could hit $5 trillion by 2030, with over 580 million users worldwide. For crypto exchange owners, this growth is a massive opportunity. But scaling a crypto exchange is tough—over 90% fail within two years due to liquidity issues, security breaches, regulatory hurdles, or poor scalability. This guide shares proven strategies to scale your exchange in 2025, covering infrastructure, security, user growth, and compliance. Whether you run a centralized (CEX), decentralized (DEX), or hybrid exchange, these tips will help you succeed.

Understanding the Challenges of Scaling

Scaling means handling more users and trades without losing speed or trust. Key challenges include:

- Liquidity Shortages: Low liquidity causes slow trades or price swings, driving users away.

- Regulatory Pressure: Rules differ by country and change often, demanding constant updates.

- Security Risks: Growth makes you a bigger target for hackers. A single breach can ruin trust.

- Scalability Limits: Weak infrastructure leads to crashes during high traffic.

Tackling these early is crucial for success.

Key Strategies for Scaling a Crypto Exchange

1. Building a Scalable Infrastructure

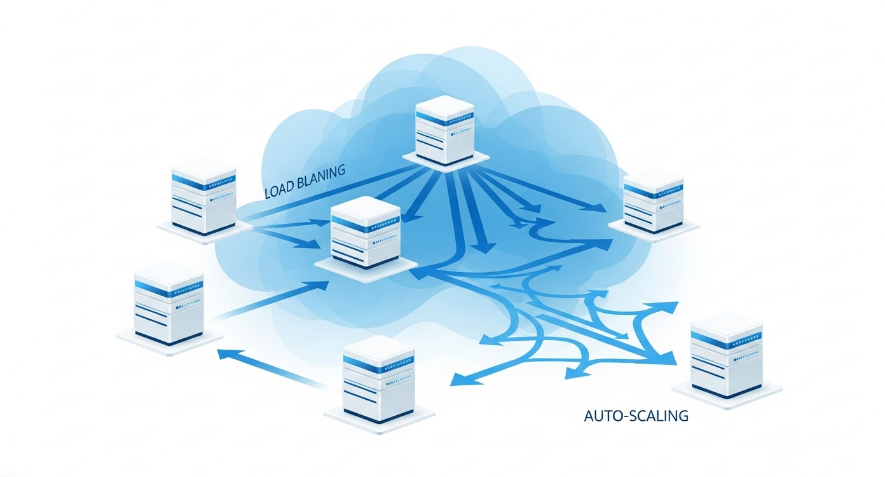

A strong infrastructure supports growth. Here’s how to build it:

- Cloud Solutions: Use AWS, Google Cloud, or Azure for flexible scaling.

- Microservices Architecture: Break your platform into smaller services for easier updates.

- Load Balancing: Spread traffic across servers to prevent crashes.

- Auto-Scaling: Adjust server capacity based on demand.

- Geographic Redundancy: Host servers globally for 99.9% uptime and low latency.

2. Ensuring Top-Notch Security

Security builds user trust. Protect your platform with:

- Cold Storage: Keep most funds offline to reduce hacking risks.

- DDoS Protection: Use tools like Cloudflare to block attacks.

- Two-Factor Authentication (2FA): Require 2FA for user accounts.

- Regular Audits: Check for vulnerabilities frequently.

- KYC/AML Compliance: Verify identities and monitor transactions.

In February 2025, Bybit lost 401,346 ETH (~$1.5 billion) in a hack, showing the stakes.

3. Optimizing the Trading Engine

A fast trading engine keeps users happy:

- Low-Latency Matching: Execute trades quickly to avoid slippage.

- Efficient Databases: Use high-speed databases for large data volumes.

- Caching: Store frequently accessed data for faster performance.

4. Expanding Product Offerings

Diverse products attract users:

- New Cryptocurrencies: List Bitcoin, Ethereum, and emerging tokens.

- Advanced Trading: Offer margin trading, futures, and options.

- Staking: Let users earn rewards by staking assets.

- DeFi Integrations: Provide yield farming and lending options.

5. Acquiring and Retaining Users

Grow your user base with:

- Referral Programs: Reward users for inviting others.

- Social Media: Promote on Twitter, Telegram, and Reddit.

- Content Marketing: Share blog posts and videos to educate users.

- SEO: Use keywords to rank higher on Google.

- Localization: Support local languages and payment methods.

6. Managing Liquidity

Liquidity ensures smooth trading:

- Market Makers: Partner with firms to provide buy/sell orders.

- Liquidity Mining: Reward users for adding liquidity.

- Cross-Exchange Integration: Share liquidity with other platforms.

7. Ensuring Regulatory Compliance

Stay legal with:

- Licenses: Obtain required licenses for your region.

- KYC/AML: Verify users and monitor transactions.

- Regulatory Updates: Track global laws to stay compliant.

8. Enhancing User Experience

A great UX retains users:

- Responsive Design: Ensure ease of use on all devices.

- Mobile Access: Offer a mobile app or responsive site.

- Fast Execution: Process trades quickly.

- Low Fees: Keep fees competitive.

9. Scaling Customer Support

Support grows with users:

- AI Chatbots: Answer common questions instantly.

- Multi-Channel Support: Offer email, chat, and phone.

- Ticketing Systems: Use tools like Zendesk for efficiency.

10. Financial Planning and Risk Management

Plan for sustainability:

- Capital Reserves: Keep funds for operations and emergencies.

- Diversified Revenue: Earn from fees, listings, and premium services.

- Volatility Management: Hedge against market swings.

Case Studies and Best Practices

Binance scales with diverse products and global marketing. Coinbase excels in compliance and institutional focus. The Bybit hack in 2025 (401,346 ETH lost) highlights the need for strong security. Learn from these to avoid mistakes.

| Exchange | Strengths | Lessons Learned |

|---|---|---|

| Binance | Diverse products, global reach | Innovate and market well |

| Coinbase | Compliance, institutional focus | Build trust through compliance |

| Bybit (Hack) | Fast growth | Prioritize security to avoid losses |

Conclusion

Scaling a crypto exchange in 2025 requires balancing infrastructure, security, products, and compliance. Monitor performance, adapt to trends, and invest in your platform to stay competitive. Start with these strategies to grow your exchange and meet user demands.

FAQs

What’s the first step to scale my exchange?

Assess your platform’s performance, security, and finances.

How do I ensure security while scaling?

Use cold storage, DDoS protection, 2FA, and regular audits.

How can I attract more users?

Use referrals, social media, content marketing, and SEO.

How do I handle global regulations?

Secure licenses, implement KYC/AML, and track legal changes.

What infrastructure is best for scalability?

Invest in cloud solutions, microservices, and load balancing.