The cryptocurrency market has seen dramatic ups and downs, leaving many investors wondering if the current bull run is over. As of July 30, 2025, evidence suggests the bull run is still alive, with Bitcoin and other major cryptocurrencies hitting new highs. This article dives into the current market state, expert predictions, historical context, and factors driving the surge to help you understand what’s happening and what might come next.

Understanding the Current State of the Crypto Market

The crypto market is showing strong momentum as of July 30, 2025. Here’s a snapshot of the latest data:

- Bitcoin Price and Market Cap: Bitcoin reached a new all-time high of $118,856 on July 12, 2025, with a market cap of $2.34 trillion. This marks a 105.7% increase from $57,341 a year earlier on July 11, 2024, and a 9.83% weekly gain from $107,483 on July 4, 2025 (CoinMarketCap).

- Total Crypto Market Cap: The total market cap is around $3.82 trillion, reflecting robust bullish momentum with a 14-day RSI of 68.14, indicating strong but not overbought growth.

- Other Cryptocurrencies: Ethereum (ETH) rose 19.05% to $2,962 (market cap $361 billion), XRP surged 22% to $2.72 (market cap $163 billion), and Solana (SOL) gained 10% to $162 (market cap $87 billion) in the past week.

These figures show that the bull run is not just a Bitcoin story but extends across major cryptocurrencies, suggesting broad market strength.

Analyzing Predictions and Expert Opinions

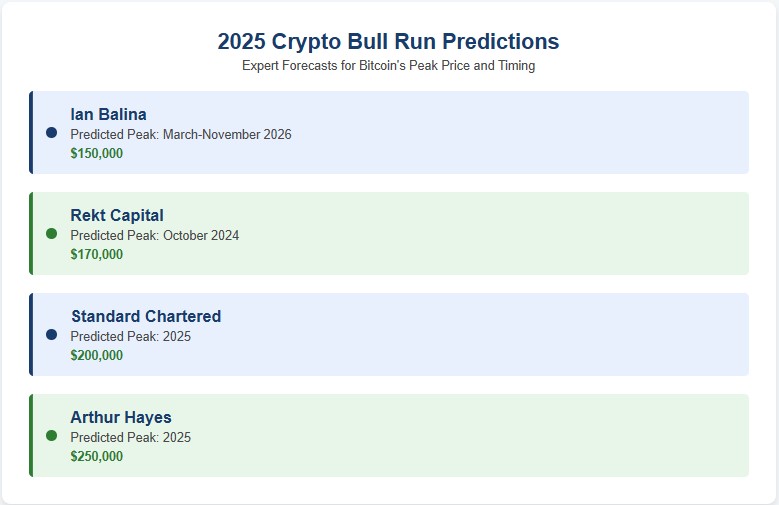

Experts have differing views on the bull run’s duration, reflecting the complexity of predicting crypto market cycles:

- Ian Balina (Token Metrics): Balina, who turned $20,000 into $5 million in 2016, predicts the bull run began in April 2024 and could last until November 2026 in the most optimistic scenario, with Bitcoin potentially reaching $150,000. He bases this on historical halving cycles and AI-driven analysis.

- Rekt Capital: In July 2025, Rekt Capital suggested the bull run might fade after October 2024, following the 2020 halving pattern (550 days post-halving). However, he noted that institutional adoption could extend the cycle to 2026, with Bitcoin possibly hitting $170,000.

- Arthur Hayes: In September 2024, Hayes predicted a delay in the bull market until September, citing macroeconomic factors like Federal Reserve policies. Since we’re now in July 2025 and prices are still climbing, this prediction seems outdated.

- Other Analysts: Standard Chartered and Bernstein predict Bitcoin could reach $200,000 by year-end, while Arthur Hayes forecasts $250,000, driven by institutional inflows and global money supply growth.

The mix of predictions shows a divide: some see the bull run continuing for another year or more, while others caution it may be nearing a peak. The fact that Bitcoin hit $118,856 in July 2025 suggests the bull run has outlasted some bearish forecasts.

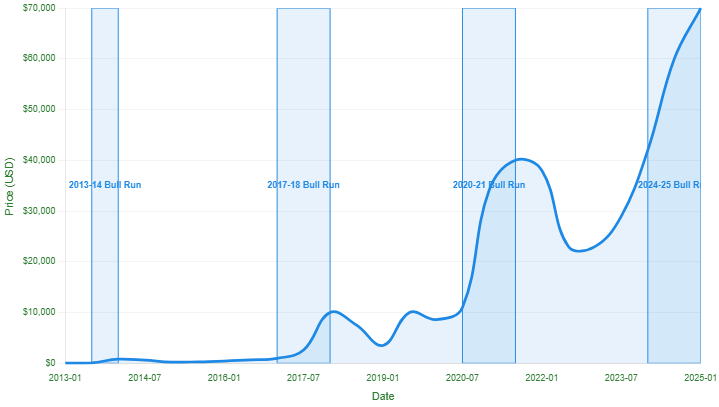

Historical Context and Market Cycles

Understanding past bull runs helps put the current market in perspective. Here’s a look at previous cycles:

| Bull Run | Start Date | Start Price | Peak Date | Peak Price | Duration | Key Driver |

|---|---|---|---|---|---|---|

| 2013-2014 | Oct 2013 | $170 | Nov 2013 | $1,127 | 104 days | Early adoption |

| 2017-2018 | Jul 2017 | $2,500 | Dec 2017 | $19,783 | 164 days | ICO boom |

| 2020-2021 | Nov 2020 | $10,000 | Apr 2021 | $64,899 | 150 days | Institutional interest |

The current bull run, starting in April 2024, has lasted over 450 days and is still ongoing, making it one of the longest in crypto history. Historically, bull runs follow Bitcoin halving events, which reduce mining rewards and create supply scarcity. The April 2024 halving likely sparked this cycle, but institutional adoption and macroeconomic factors are now significant drivers, potentially extending the cycle beyond traditional patterns.

Factors Influencing the Current Bull Run

Several key factors are fueling the 2025 bull run:

- Institutional Adoption: Spot Bitcoin ETFs, launched in January 2024, have attracted billions in inflows, with $17.3 billion recorded by September 2024 and $8 billion more since April 2025. This has boosted demand and positioned Bitcoin as a competitor to gold.

- Regulatory Clarity: G20 nations, led by India, have endorsed a regulatory roadmap favoring oversight over bans, boosting investor confidence.

- Technological Advancements: Integration with AI, metaverse, and decentralized applications (dApps) is drawing new users and capital, particularly for Ethereum, Solana, and Cardano.

- Macroeconomic Conditions: Low interest rates and increased liquidity, influenced by Federal Reserve policies, support risk assets like cryptocurrencies. However, potential rate hikes or economic shifts could pose risks.

These factors suggest the bull run has strong foundations, but volatility remains a concern, as seen in a 7.48% market cap drop to $2.91 trillion in February 2025.

When Will the Bull Run End?

Predicting the end of a bull run is tricky, but experts offer these scenarios:

- Bear Scenario (Token Metrics): Ends March 2026, with Bitcoin at $150,000 and total market cap at $8 trillion.

- Base Scenario (Token Metrics): Ends June 2026, with Bitcoin at $150,000 and market cap at $10 trillion.

- Moon Scenario (Token Metrics): Ends November 2026, with Bitcoin at $150,000 and market cap at $14 trillion.

- Warning Signs: A sustained Bitcoin price drop below $90,000 for over two months or a sharp rise in the Fear & Greed Index to extreme greed levels could signal a peak.

The extension of the bull run beyond October 2024, as predicted by some, suggests institutional and technological factors may be lengthening the cycle. Investors should watch for sudden price drops or macroeconomic shifts.

FAQs

- How long does a crypto bull run last? Historically, bull runs last from a few months to over a year, with the current one (April 2024–July 2025) already at 450+ days, potentially extended by institutional adoption.

- How can I spot a bull run peak? Look for signs like extreme greed on the Fear & Greed Index, a surge in meme coin trading, or a drop in Bitcoin dominance as investors chase riskier altcoins.

- Is it too late to invest in the 2025 bull run? While prices are high, opportunities remain in fundamentally strong projects. Diversify and set clear profit targets to manage risks.

- What triggers a crypto bull run? Key triggers include Bitcoin halvings, institutional investments, regulatory clarity, and technological innovations like DeFi or NFTs.

Conclusion

As of July 30, 2025, the crypto bull run is not over. Bitcoin’s recent high of $118,856 and a total market cap of $3.82 trillion show strong momentum. While some experts predicted a peak in October 2024, the market has continued to climb, driven by institutional investments, regulatory progress, and technological innovations. Predictions now range from March to November 2026 for the bull run’s end, with Bitcoin potentially hitting $150,000 or more.

Investors should stay cautious, as crypto markets are volatile. Monitor price trends, regulatory changes, and economic indicators like Federal Reserve policies. For those looking to act, consider learning how to buy crypto without KYC or how to withdraw money from Crypto.com. Always research thoroughly and manage risks before investing.

Explore more: