Cryptocurrency has become a popular way to invest, but it can be confusing for beginners. This guide will help you understand what cryptocurrency is, why you might want to invest in it, and how to get started safely. Written for readers at a 6th-8th grade level, this article provides clear, actionable steps to begin your crypto journey while avoiding common pitfalls.

What is Cryptocurrency?

Cryptocurrency is digital money that uses blockchain technology. Unlike traditional money, it’s not controlled by governments or banks. Instead, it operates on a decentralized network, meaning no single entity has full control. The most well-known cryptocurrency is Bitcoin, but there are thousands of others, like Ethereum, Tether, and Solana.

- Key Features of Cryptocurrency:

- Digital and Decentralized: Exists only online and isn’t tied to any central authority.

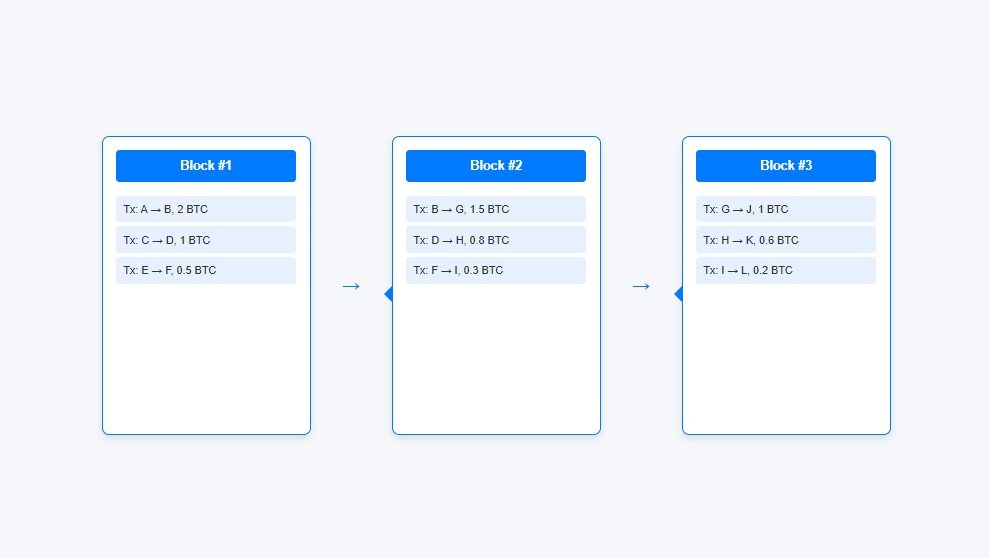

- Blockchain Technology: Transactions are recorded on a public ledger called a blockchain, ensuring security and transparency.

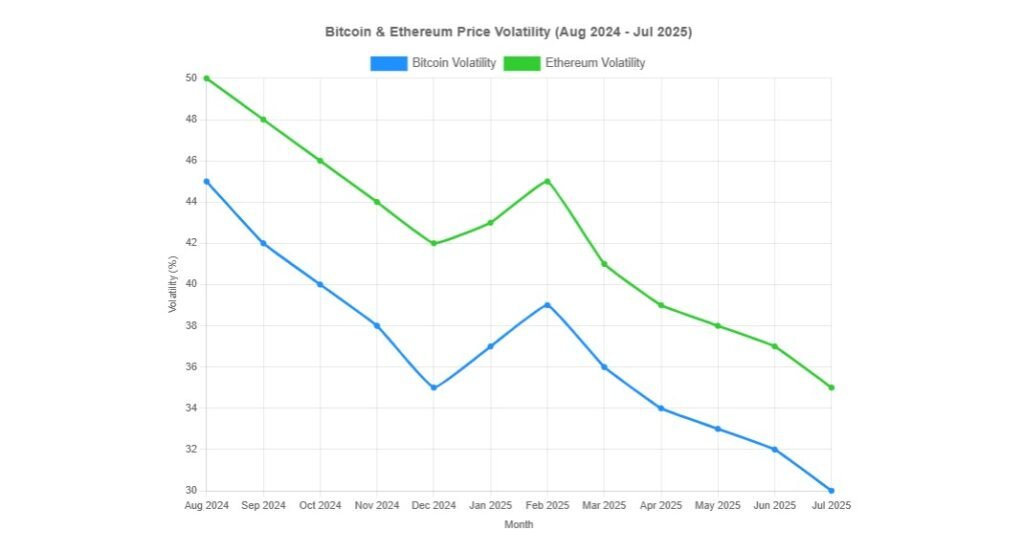

- Volatile: Prices can change rapidly, offering high potential returns but also significant risks.

Why Invest in Cryptocurrency?

Investing in cryptocurrency can offer high returns because it’s a new and growing market. For instance, Bitcoin’s market cap reached over $2 trillion in 2025, and the total crypto market is worth over $3.3 trillion. However, it’s also very volatile, meaning prices can go up and down quickly. Here are the pros and cons:

| Pros | Cons |

|---|---|

| High growth potential (e.g., Bitcoin’s rise from pennies to $100,000 by December 2024) | High volatility, with prices dropping fast |

| Diversifies your investment portfolio | Regulatory uncertainty in many countries |

| 24/7 market access, unlike stocks | Risk of hacks, scams, and fraud |

Tip: Only invest money you can afford to lose, as crypto is a high-risk asset.

Steps to Start Investing in Cryptocurrency

Follow these five steps to begin your crypto investment journey:

Step 1: Educate Yourself

- Learn about different cryptocurrencies and their uses:

- Bitcoin (BTC): Often seen as digital gold, used as a store of value.

- Ethereum (ETH): Known for smart contracts and decentralized apps.

- Tether (USDT): A stablecoin pegged to the US dollar, less volatile.

- Understand blockchain technology and how it secures transactions.

- Research risks, including market volatility and security threats.

Learn more about specific cryptocurrencies like What is SUI Crypto?

Step 2: Choose a Reputable Exchange

- Select a trusted cryptocurrency exchange or brokerage. Popular options include:

- Coinbase: User-friendly for beginners.

- Binance: Offers a wide range of cryptocurrencies.

- Kraken: Known for strong security.

- Consider these factors:

- Fees: Look for low trading, deposit, and withdrawal fees.

- Security: Ensure the exchange uses two-factor authentication (2FA) and other protections.

- User Experience: Choose a platform that’s easy to navigate.

- Verify if the exchange is regulated in your country for added safety.

Check out How to Buy Crypto Without KYC for alternative purchasing options.

Step 3: Set Up an Account

- Visit the exchange’s website and create an account.

- Complete the verification process, which may require ID documents (Know Your Customer, or KYC).

- Enable 2FA to protect your account from unauthorized access.

Step 4: Fund Your Account

- Deposit money using methods like:

- Bank Transfer: Often the cheapest option.

- Credit/Debit Card: Faster but may have higher fees.

- Check for any deposit fees before transferring funds.

Learn about Crypto.com Fees to understand platform-specific costs.

Step 5: Make Your First Purchase

- Search for the cryptocurrency you want to buy.

- Place an order:

- Market Order: Buy at the current price.

- Limit Order: Buy at a specific price you set.

- Start with a small amount, like $100, to minimize risk.

How to Secure Your Cryptocurrency

Security is critical in crypto investing. Here’s how to protect your assets:

- Types of Wallets:

- Hot Wallets: Online wallets (e.g., on exchanges) that are convenient but more vulnerable to hacks.

- Cold Wallets: Offline hardware wallets (e.g., Ledger, Trezor) that are more secure but less convenient.

- Best Practices:

- Use strong, unique passwords for all accounts.

- Enable 2FA wherever possible.

- Never share your seed phrases (recovery phrases) with anyone.

- Be cautious of phishing scams—always verify website URLs before entering sensitive information.

Explore How to Buy Crypto with Tangem Wallet for secure wallet options.

Investment Strategies for Beginners

To invest wisely, consider these strategies:

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly (e.g., $25 weekly) to reduce the impact of price volatility.

- Diversification: Spread your investments across different cryptocurrencies to minimize risk.

- Set Realistic Expectations: Crypto is not a get-rich-quick scheme. Focus on long-term growth.

- Start Small: Allocate only a small percentage of your portfolio to crypto (e.g., less than 5%).

Understanding the Tax Implications

In many countries, cryptocurrencies are treated as property for tax purposes. This means:

- Capital Gains Tax: If you sell crypto for a profit, you may owe taxes on the gain.

- Record-Keeping: Track all transactions, as you’ll need to report them.

- Consult a Tax Professional: Tax laws vary by country, so seek expert advice.

Learn more about Do You Pay Taxes on Crypto Before Withdrawal?

Common Mistakes to Avoid

Avoid these pitfalls when starting out:

- Investing More Than You Can Afford: Only use money you’re comfortable losing.

- Falling for Scams: Be wary of too-good-to-be-true offers or unsolicited messages.

- Not Researching Enough: Investigate a cryptocurrency’s purpose, team, and community before investing.

Frequently Asked Questions (FAQs)

- What is the best cryptocurrency to invest in?

There’s no single “best” crypto. Research and choose based on your risk tolerance and goals. Bitcoin and Ethereum are popular for beginners due to their established track records. - Is cryptocurrency safe?

It can be safe with secure wallets and best practices, but risks like hacking and scams exist. Always prioritize security. - How do I choose a crypto exchange?

Look for exchanges with strong security, low fees, and good reputations. Check user reviews and regulatory compliance. - How do I store my cryptocurrency?

Use hot wallets for trading and cold wallets for long-term storage. Hardware wallets are the most secure option. - What is blockchain technology?

Blockchain is a digital ledger that records transactions securely and transparently. It’s the backbone of cryptocurrencies.

Conclusion

Starting to invest in cryptocurrency can be an exciting journey, but it requires caution and preparation. Educate yourself, choose a reputable exchange, secure your assets, and start small. The crypto market is volatile, so only invest what you can afford to lose. By following these steps and staying informed, you can confidently begin your crypto investment journey.