Cryptocurrency markets are known for wild price swings. Prices can change dramatically in a single day, which can lead to big gains but also significant losses. Hedging is a strategy that helps protect your crypto investments from these unpredictable movements. One of the most effective ways to hedge is by using futures contracts. This guide explains what hedging is, why it’s important, and how you can use futures to safeguard your crypto portfolio on Krypdrops.com.

What is Hedging?

Hedging is a risk management technique that involves taking an opposite position to protect against potential losses. In crypto, this means using financial tools like futures to counterbalance the risk of holding cryptocurrencies. For example, if you own Bitcoin and worry about a price drop, you can use a futures contract to lock in a price or offset losses.

Why is Hedging Important in Crypto?

- Volatility: Crypto prices can swing by 10% or more in a day, making them risky.

- Protection: Hedging lets you keep your crypto while reducing the impact of price drops.

- Stability: It helps stabilize your portfolio, giving you peace of mind.

Hedging is especially useful in crypto because of its high volatility. According to data from Portfolios Lab (August 2023), Bitcoin has an annualized return of 47.88% but also high volatility, making hedging a valuable tool.

Understanding Crypto Futures

Before exploring hedging strategies, let’s understand what crypto futures are and how they work.

What are Futures Contracts?

A futures contract is an agreement to buy or sell a cryptocurrency at a set price on a specific future date. These contracts are traded on exchanges like Coinbase Derivatives or CME and are standardized with fixed sizes and expiration dates.

How Do Futures Work in Crypto?

- Going Long: You buy a futures contract if you think the price will rise.

- Going Short: You sell a futures contract if you expect the price to fall.

- Hedging: You use futures to offset risks in your spot (actual) crypto holdings.

For example, if you own 1 BTC and sell a futures contract at $50,000, you can profit from the futures if the price drops, offsetting losses in your spot position.

Futures vs. Perpetual Contracts

- Futures: Have an expiration date and must be settled or rolled over.

- Perpetual Contracts: Have no expiration and use funding rates to track the spot price. They’re popular in crypto for continuous trading.

Perpetual contracts are widely used because they allow flexibility without worrying about expiry dates. Learn more about perpetual contracts at Crypto.com.

Hedging Strategies with Futures

There are several ways to hedge your crypto using futures. Here are the most common strategies:

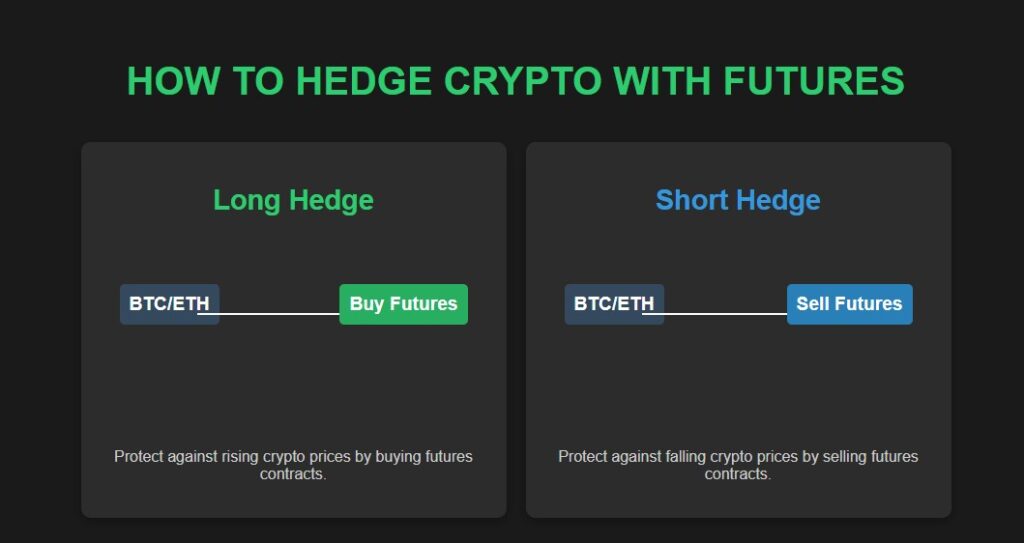

Short Hedge

- Definition: A short hedge involves selling a futures contract to protect against a price drop in your spot holdings.

- How It Works: If you own a crypto and fear its price will fall, you sell a futures contract. If the price drops, your futures profit offsets the loss.

- Example: You hold 1 BTC at $50,000. You sell a BTC futures contract at $50,000. If the price drops to $40,000, you buy back the futures at $40,000, making a $10,000 profit to offset your spot loss.

Long Hedge

- Definition: A long hedge involves buying a futures contract to protect against a price increase in an asset you plan to buy later.

- How It Works: If you plan to buy crypto in the future but worry about rising prices, you buy futures now to lock in a price.

- Example: You plan to buy 100 ETH in three months at $2,000 each. You buy ETH futures at $2,000. If the price rises to $2,500, you sell the futures at $2,500, making a $500 profit per ETH to offset the higher spot cost.

Cross-Hedging

- Definition: When futures for your crypto aren’t available, you use futures of a correlated asset.

- When to Use: Useful for less liquid cryptos or when direct futures are unavailable.

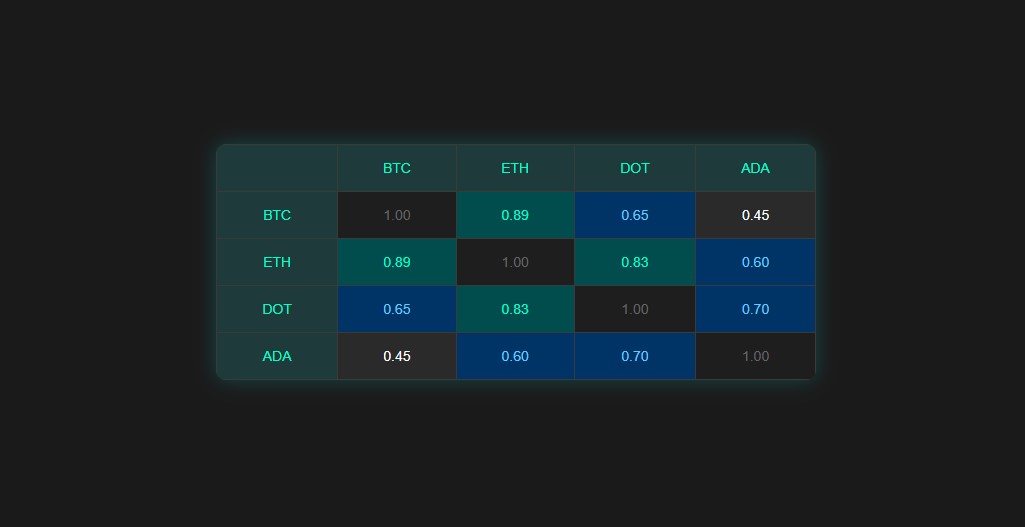

- Example: If you hold Polkadot (DOT) and no DOT futures exist, you can use ETH futures since DOT and ETH have a high correlation (0.83, August 2023). You calculate a hedge ratio based on their volatilities and correlation.

Practical Considerations for Hedging

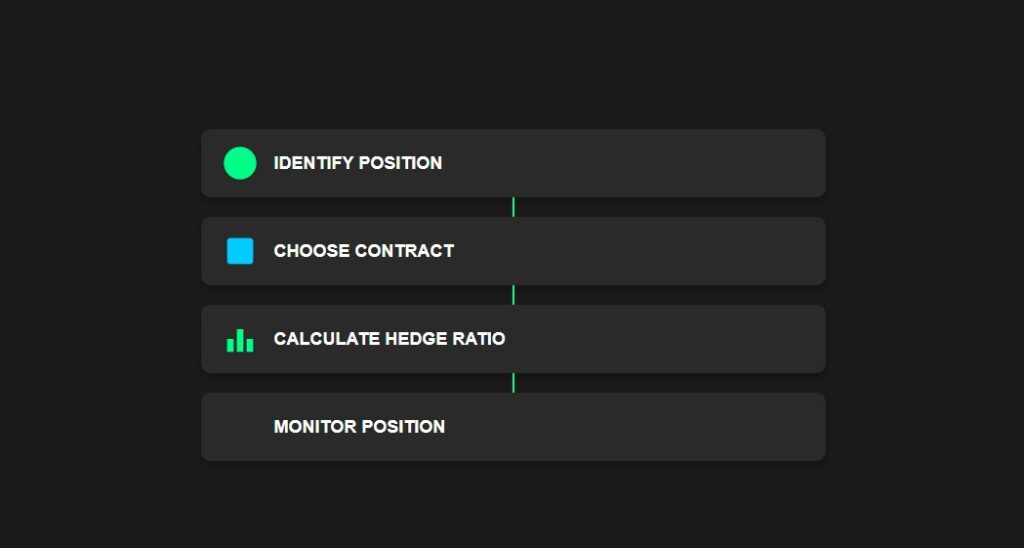

Hedging with futures is effective but requires careful planning. Here are key factors to consider:

Choosing the Right Exchange and Contract Size

Different exchanges offer various contract sizes, which affect costs and flexibility. For example:

| Exchange | Large BTC Contract | Small BTC Contract | Large ETH Contract | Small ETH Contract |

|---|---|---|---|---|

| Coinbase Derivatives Exchange | 1 BTC | 0.01 BTC | 10 ETH | 0.1 ETH |

| CME | 5 BTC | 0.1 BTC | 50 ETH | 0.1 ETH |

Choose a contract size that matches your position to avoid over- or under-hedging. Check out Coinbase Derivatives for more details.

Understanding Correlations

Correlations between cryptos help you choose the right futures for hedging. For example, BTC and ETH have a high correlation (0.89), so ETH futures can partially hedge BTC positions. Monitor correlations as they can change over time.

Managing Costs and Risks

- Fees: Include brokerage fees, exchange fees, and funding rates for perpetual contracts.

- Counterparty Risk: Use regulated exchanges to reduce the risk of the other party defaulting.

- Basis Risk: The difference between spot and futures prices can lead to imperfect hedges.

- Execution Risk: Volatile markets can make it hard to execute trades at desired prices.

Case Studies: Real-World Hedging Scenarios

Hedging Staked Positions

If you’ve staked ETH, you can use ETH futures to hedge against price drops. For other staked assets like DOT or ADA, use cross-hedges with BTC or ETH futures based on correlations. For example, to hedge $1 of DOT, you might use $1.07 of ETH futures (hedge ratio: 1.07, August 2023).

Hedging Locked Assets

For tokens locked in vesting periods (e.g., ARB, AVAX, SUI), use BTC or ETH futures. ARB has a 0.68 correlation with ETH and 0.63 with BTC, making these viable hedging options.

Hedging for Miners

Bitcoin miners can sell BTC futures to lock in prices for future production. For example, selling futures at $25,000 ensures $25,000 per BTC mined, regardless of whether the spot price is $26,000 or $20,000 at expiry.

Tips for Effective Hedging

- Understand Risks: Know the fees, counterparty risk, basis risk, and execution risk.

- Start Simple: Begin with basic short or long hedges before trying complex strategies.

- Diversify: Use multiple hedging methods to spread risk.

- Use Tools: Risk management tools like stop-loss orders can limit losses. Learn more at Crypto Slippage Explained.

- Seek Advice: Consult a financial advisor experienced in crypto if you’re unsure.

People Also Ask: Common Questions Answered

- How can I protect my crypto portfolio from price drops? Use short hedges with futures to offset losses if prices fall.

- What are the best ways to hedge crypto investments? Short hedges, long hedges, and cross-hedging are effective, depending on your needs.

- Can I use Bitcoin futures to hedge other cryptocurrencies? Yes, if the assets are correlated, like ETH or DOT with BTC.

- What are the risks of hedging with futures? Risks include fees, counterparty risk, basis risk, and execution challenges in volatile markets.

- How do I start hedging on an exchange? Choose a regulated exchange, select the right contract size, and calculate your hedge based on correlations and position size.

Conclusion

Hedging with futures is a powerful way to protect your cryptocurrency investments from market volatility. By understanding futures, using strategies like short and long hedges, and considering practical factors like correlations and costs, you can safeguard your portfolio. While hedging reduces risk, it also limits potential gains, so use it wisely. Start with simple strategies and explore platforms like Coinbase or Crypto.com to get started.

Explore more: