Cryptocurrency markets are unlike any other financial market—they never close. Whether it’s day or night, weekday or weekend, you can trade cryptocurrencies 24/7, 365 days a year. This round-the-clock availability is one of the defining features of the crypto world, but it also comes with its own set of advantages and challenges. In this article, we’ll explore whether crypto markets close, why they operate this way, and how you can make the most of their unique trading hours.

Understanding Crypto Market Hours

The cryptocurrency market operates continuously because it is decentralized. Unlike traditional stock markets, which are tied to specific physical locations and operating hours (like the New York Stock Exchange, open from 9:30 a.m. to 4:00 p.m. ET on weekdays), crypto markets are powered by blockchain technology. This means transactions happen on a global network of computers, not in a centralized exchange building. As long as there’s internet access, trading can occur at any time.

- No Opening or Closing Bells: There’s no “market open” or “market close” in crypto. You can buy, sell, or trade cryptocurrencies whenever you want.

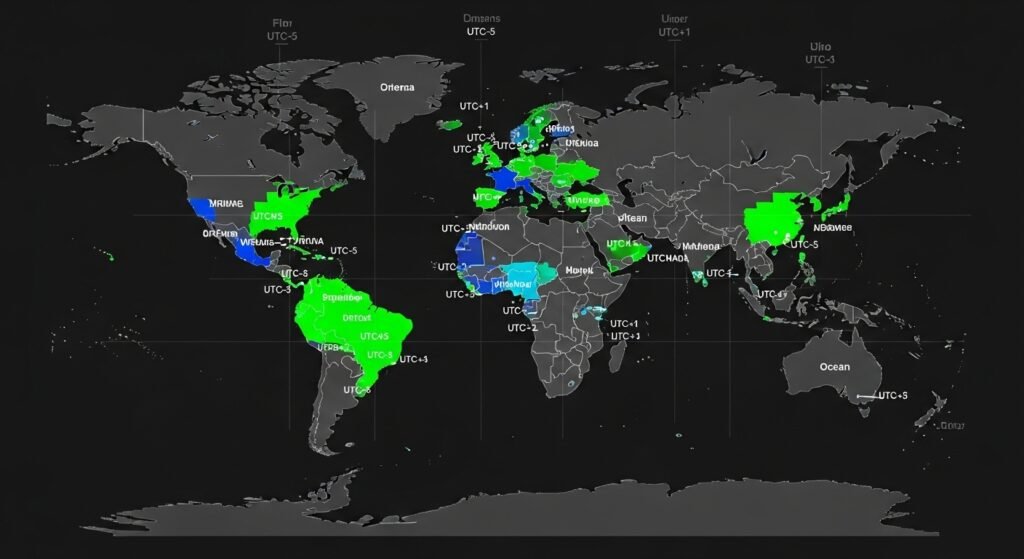

- Global Participation: Traders from all time zones can participate, making the market truly global.

This 24/7 nature is a key difference from traditional markets, which have strict trading hours and are closed on weekends and holidays.

Advantages of 24/7 Crypto Markets

The continuous operation of crypto markets offers several benefits for traders:

- Flexibility: You can trade at any time that suits your schedule, whether you’re a night owl or an early riser.

- Real-Time Reactions: You can respond immediately to news, events, or market changes without waiting for the next trading day.

- Increased Liquidity: With constant trading, there’s always someone willing to buy or sell, which can lead to tighter bid-ask spreads.

- Global Accessibility: Traders from different parts of the world can participate simultaneously, creating a more dynamic market.

However, this constant availability also means you need to stay vigilant, as market conditions can change rapidly at any time. For more on how to start trading, check out How to Start Investing in Cryptocurrency.

Are There Any Exceptions?

While the crypto market itself never closes, there are a few exceptions to be aware of:

- Exchange Maintenance: Individual crypto exchanges like Binance or Coinbase may temporarily halt trading for maintenance or upgrades. These periods are usually announced in advance. For example, Binance occasionally pauses trading for system updates, typically lasting 30–60 minutes.

- Specific Products: Some financial products tied to crypto, such as cryptocurrency CFDs (Contracts for Difference), may have limited trading hours depending on the broker or platform. For instance, FOREX.com offers crypto CFD trading from 9:00 p.m. Sunday to 9:00 p.m. Friday UTC.

These are not closures of the entire crypto market but rather brief pauses on specific platforms or for certain products.

Best Times to Trade Crypto

Even though the market is always open, trading activity isn’t evenly distributed throughout the day. Certain periods see higher trading volumes and liquidity, which can be more favorable for traders.

- Peak Hours: Cryptocurrencies are most actively traded between 8:00 a.m. and 4:00 p.m. local time, especially on weekdays. This aligns with traditional stock market hours, particularly when the NYSE is open (9:30 a.m. to 4:00 p.m. ET). Institutional investors and large trading firms are often active during this time, increasing liquidity.

- Overlap of Major Markets: The overlap between U.S. and European trading sessions (roughly 3:00 p.m. to 11:00 p.m. UTC) often sees the highest trading volumes due to increased participation from both regions.

- Weekends: Trading is still possible on weekends, but volumes are typically lower, and the market can be more volatile due to reduced liquidity. This can lead to larger price swings, which some traders use to their advantage, while others find it riskier.

For Indian traders, the best times to trade might be in the evening, overlapping with European and U.S. market hours, typically from 6:00 p.m. to 1:00 a.m. IST. This period often sees higher liquidity and price movements. To learn more about trading mechanics, see Crypto Slippage Explained.

Pros and Cons of 24/7 Trading

The 24/7 nature of crypto markets is both a blessing and a challenge. Here’s a breakdown:

To manage these risks, consider setting clear price targets and using tools like stop-loss orders. For advanced strategies, explore Can You Short Crypto?.

Tools and Resources for Crypto Trading

To navigate the 24/7 crypto market effectively, you can use various tools and resources:

- Exchanges: Platforms like Binance, Coinbase, and Kraken allow you to trade cryptocurrencies around the clock.

- Trading Bots: Automated algorithms can execute trades based on predefined criteria, helping you manage the market when you’re not actively monitoring it.

- Portfolio Trackers: Apps like CoinTracker provide real-time updates on your crypto holdings, helping you stay informed about market movements.

- News Aggregators: Staying updated with crypto news is crucial. Websites like CoinDesk and Cointelegraph offer timely updates on market trends and events.

For those new to crypto, How to Buy Crypto Without KYC offers tips on getting started.

People Also Ask: Common Questions Answered

- Does the crypto market close on weekends? No, crypto markets are open 24/7, including weekends. However, trading volumes may be lower, leading to higher volatility.

- What are the risks of 24/7 trading? Risks include impulsive trading, higher volatility during low-volume periods, and potential burnout from constant market monitoring. Using tools like stop-loss orders can help manage these risks.

- How does 24/7 trading affect crypto prices? The continuous market allows prices to react instantly to news or events, but low trading volumes during off-peak hours can cause larger price swings.

- Can I trade crypto at night? Yes, you can trade at any time, day or night, due to the decentralized nature of crypto markets.

Conclusion

In summary, crypto markets do not close—they are open 24/7, offering unparalleled flexibility and accessibility. This continuous operation provides numerous advantages, such as global accessibility and real-time reactions to market changes, but it also comes with challenges like increased volatility and the need for constant vigilance. By understanding the market dynamics, choosing the best times to trade, and using the right tools, traders can navigate this ever-active landscape effectively.

Stay informed, trade wisely, and remember that in the world of crypto, the market never sleeps. For more insights on market trends, check out Will Crypto Recover?.