Slippage is a key concept for anyone trading cryptocurrencies. It refers to the difference between the price you expect for a trade and the price at which it is actually executed. This issue is especially common in crypto due to its high volatility and sometimes lower liquidity compared to traditional markets like stocks or forex. Understanding slippage can help you make smarter trading decisions and protect your profits.

In this post, we’ll explain what slippage is, why it happens, how it affects your trades, and practical steps to minimize its impact. Whether you’re new to crypto or an experienced trader, this guide will provide actionable insights to improve your trading strategy.

What is Slippage in Crypto?

Slippage occurs when the price you expect to pay or receive for a cryptocurrency differs from the actual price at execution. For example:

- You place an order to buy Ethereum at $2,000.

- By the time the trade is executed, the price has risen to $2,050.

- The $50 difference is slippage.

Slippage can be:

- Positive: You get a better price than expected (e.g., buying at $1,950 instead of $2,000).

- Negative: You get a worse price than expected (e.g., buying at $2,050 instead of $2,000).

Positive slippage is rare but beneficial, while negative slippage is more common and can reduce profits or increase losses. Understanding this concept is crucial for managing risks in crypto trading.

Why Does Slippage Happen?

Slippage is driven by several factors, primarily market volatility and low liquidity:

- Market Volatility: Cryptocurrencies are known for rapid price swings. News events, market sentiment, or large trades can cause prices to change between the time you place an order and when it’s executed.

- Low Liquidity: In markets with fewer buyers and sellers (common for smaller altcoins), large orders can significantly move the price, leading to higher slippage.

- Order Type: Market orders, which execute at the best available price, are more susceptible to slippage than limit orders, which only execute at a specified price or better.

- Network Congestion: On decentralized exchanges (DEXs), delays due to blockchain congestion or high gas fees can increase slippage by slowing down trade execution.

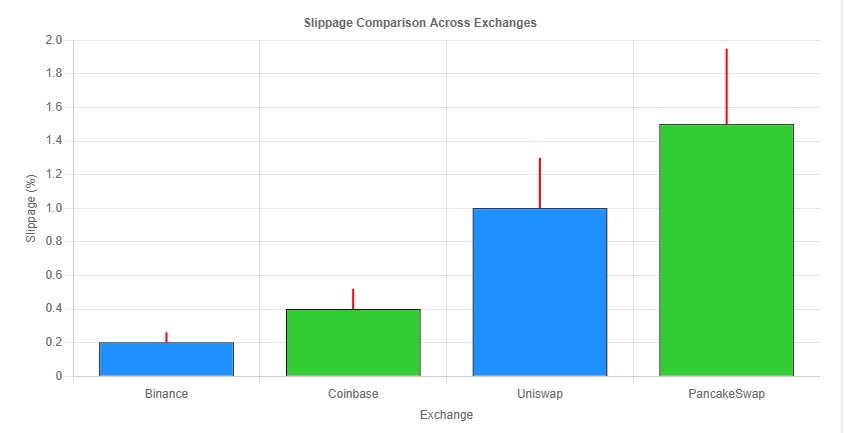

Slippage is more pronounced on DEXs like Uniswap compared to centralized exchanges (CEXs) like Binance, where liquidity is typically higher.

Types of Slippage

Positive Slippage

Positive slippage occurs when your trade executes at a better price than expected. For example:

- You place a buy order for Bitcoin at $60,000, but it executes at $59,900.

- This saves you $100 per Bitcoin, boosting your potential profit.

Positive slippage is less common but can happen in fast-moving markets when prices move in your favor.

Negative Slippage

Negative slippage is when your trade executes at a worse price than expected. For example:

- You aim to sell Ethereum at $2,000, but the trade executes at $1,950.

- This results in a $50 loss per Ethereum compared to your expected price.

Negative slippage is more frequent in crypto, especially during volatile periods or in low-liquidity markets.

How to Minimize Slippage in Crypto Trading

While slippage can’t be completely avoided, you can reduce its impact with these strategies:

1. Use Limit Orders

Limit orders let you set a specific price for your trade, ensuring it only executes at that price or better. Unlike market orders, which fill at the current market price, limit orders help avoid negative slippage. However, there’s a risk your order won’t be filled if the market doesn’t reach your price.

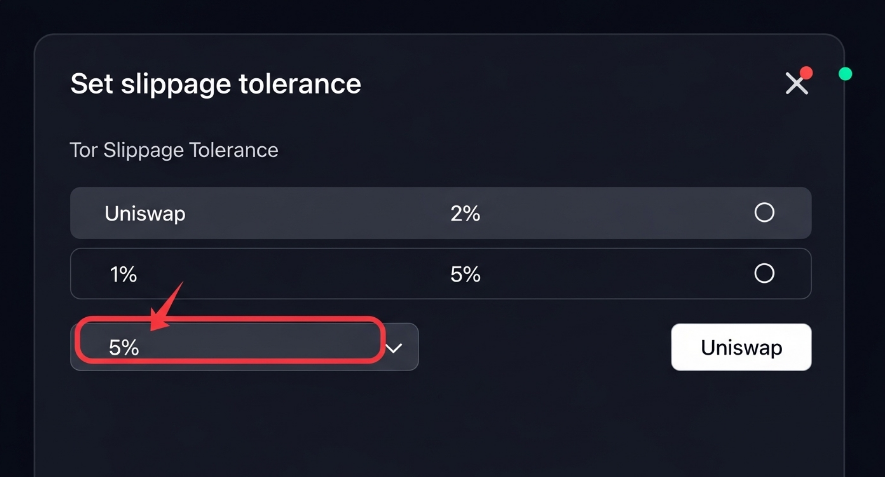

2. Set Slippage Tolerance

On DEXs like Uniswap or PancakeSwap, you can set a slippage tolerance (e.g., 1-2%) to limit how much the execution price can differ from the expected price. If the price moves beyond your tolerance, the trade is canceled. A good rule of thumb:

3. Trade on High-Liquidity Platforms

Exchanges with high trading volumes, like Binance or Coinbase, have more buyers and sellers, reducing slippage. Before trading, check the liquidity of the asset on the platform to ensure there’s enough volume to support your order.

4. Avoid Trading During High Volatility

Avoid placing trades during major news events, such as regulatory announcements or Bitcoin halving events, when prices can swing wildly. Trading during stable periods, like when U.S. and European markets overlap, can reduce slippage.

5. Split Large Trades

Large orders can move the market price, especially in low-liquidity markets. Break large trades into smaller chunks to minimize their impact. For example:

Slippage in Different Markets

Slippage isn’t unique to crypto—it occurs in stocks, forex, and futures markets too. However, it’s more pronounced in crypto due to:

- Higher Volatility: Crypto prices can change by 5-10% in minutes, compared to smaller moves in stocks.

- Lower Liquidity: Many altcoins have thin order books, unlike major stocks or forex pairs.

- Decentralized Exchanges: DEXs rely on liquidity pools, which can be less deep than CEX order books.

For example, in stock markets, slippage is often minimal due to high liquidity, while in crypto, even major assets like Bitcoin can experience significant slippage during volatile periods.

Read more about slippage in traditional markets on Investopedia.

Real-World Examples of Slippage in Crypto

Here are two notable cases that highlight the impact of slippage:

- January 2024 Dogwifhat Trade: A trader attempted to buy $9 million worth of dogwifhat (WIF), a meme coin, in a low-liquidity market. Due to the large order size and limited liquidity, they paid significantly more than expected, resulting in a $5.7 million loss from slippage alone.

- March 2024 Bitcoin Trade: A UK investor lost £10,000 per BTC (about 15% of their expected £67,000 purchase price) due to poor timing during a volatile market period. Using a limit order or waiting for a calmer market could have reduced this loss.

These examples show why managing slippage is critical for successful trading.

Frequently Asked Questions (FAQs)

What is slippage tolerance?

Slippage tolerance is a setting on some platforms, especially DEXs, that lets you specify the maximum percentage difference between the expected and actual execution price. For example, a 2% tolerance means your trade won’t go through if the price moves more than 2%.

Does slippage only happen in crypto?

No, slippage occurs in all markets, including stocks and forex. However, it’s more common in crypto due to higher volatility and lower liquidity.

Can I calculate slippage before placing a trade?

You can’t predict slippage exactly, but you can estimate it based on market conditions like volatility and liquidity. Some platforms offer tools to gauge potential slippage.

Are there ways to avoid slippage entirely?

Slippage is inherent to trading, but you can minimize it using limit orders, slippage tolerance settings, and trading on high-liquidity platforms.

How does liquidity impact slippage?

Higher liquidity means more buyers and sellers, which reduces slippage by allowing trades to execute closer to the expected price.

Learn how to set slippage tolerance on DEXs at 1inch.

Conclusion

Slippage is an unavoidable part of crypto trading, but it doesn’t have to derail your strategy. By using limit orders, setting slippage tolerance, trading on high-liquidity platforms, avoiding volatile periods, and splitting large trades, you can significantly reduce its impact. Understanding slippage empowers you to trade smarter and protect your profits in the fast-moving crypto market.

Explore more: