Cryptocurrency can seem complex, but one key term stands out: market cap. What does market cap mean in crypto, and why is it so important? This guide explains market capitalization in simple terms, covering its definition, calculation, categories, and significance for investors. Whether you’re new to crypto or an experienced trader, understanding market cap can help you make informed decisions.

What Is Market Cap in Crypto?

Market capitalization, or market cap, is the total value of a cryptocurrency’s circulating coins or tokens. It’s calculated by multiplying the current price of one coin by the number of coins in circulation.

Formula:

Market Cap = Current Price × Circulating Supply

For example, if a crypto costs $50 per coin and has 2 million coins in circulation, its market cap is $100 million ($50 × 2,000,000). This number helps you compare the size and value of different cryptocurrencies. Unlike price alone, market cap shows the overall worth of a crypto, making it a key metric for investors.

How Is Market Cap Calculated?

Market cap calculation is simple but relies on two factors:

- Current Price: The price of one coin on exchanges at a specific time. Prices can change quickly due to market activity.

- Circulating Supply: The number of coins available for trading. This excludes coins that are locked, reserved, or not yet released.

For instance, as of July 2025, Bitcoin has about 19.5 million coins in circulation out of its 21 million total supply. Its market cap is the current price multiplied by those 19.5 million coins. Always check the circulating supply, not the total supply, for accurate market cap figures.

Categories of Cryptocurrencies by Market Cap

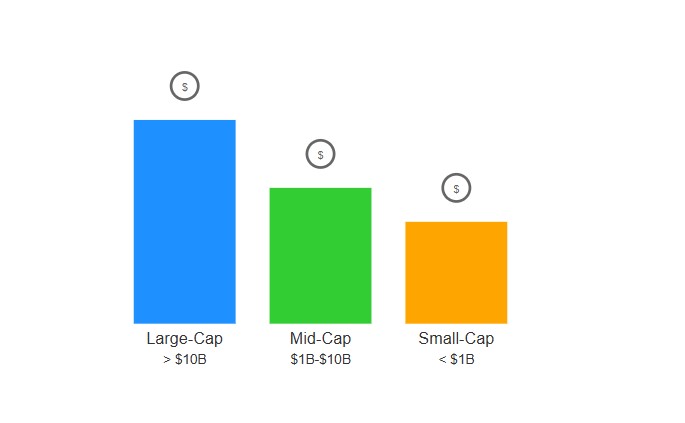

Cryptocurrencies are grouped into three categories based on their market cap, each with unique traits:

- Large-Cap (> $10 billion): These are well-known cryptos like Bitcoin ($1.9 trillion in 2024) and Ethereum ($390 billion). They’re more stable and less risky due to strong adoption and liquidity.

- Mid-Cap ($1 billion–$10 billion): These, like Binance Coin or Cardano, balance stability and growth potential. They’re riskier than large-caps but less volatile than small-caps.

- Small-Cap (< $1 billion): These are newer or niche projects, highly volatile but with potential for big returns. They carry the highest risk.

Why Is Market Cap Important?

Market cap matters because it helps investors:

- Compare Cryptos: It shows a crypto’s total value, not just its price per coin. A $0.50 coin with 1 billion coins has a larger market cap ($500 million) than a $1,000 coin with 100,000 coins ($100 million).

- Assess Risk: Large-cap cryptos are generally safer, while small-caps are riskier but may offer higher returns.

- Track Trends: Rising market caps can show growing interest, while falling caps may signal declining confidence. The total crypto market cap was $3.97 trillion as of July 26, 2025, up 4.4% in a day.

- Diversify Portfolios: Investors mix large-, mid-, and small-cap cryptos to balance risk and reward.

Market cap isn’t a profit indicator or a measure of cash invested. It’s a snapshot of current value.

Common Myths About Market Cap

Here are some misconceptions to avoid:

- Myth: Market cap shows money invested. It’s just price times circulating supply, not actual cash flow.

- Myth: High market cap means high price. A crypto with many coins at a low price can have a larger market cap than one with few coins at a high price.

- Myth: Market cap predicts future prices. It reflects current value, not future performance. Other factors like tech and adoption matter more.

FAQs

What’s the difference between circulating and total supply?

Circulating supply is coins available for trading. Total supply includes all coins created, even those not yet released, like unmined Bitcoin or locked tokens.

How does market cap affect investment choices?

It helps gauge risk and size. Large-caps suit cautious investors, while small-caps attract those seeking high returns with high risk.

Can market cap predict price changes?

No, it’s a current valuation, not a future price indicator. Always research tech, adoption, and market trends.

What’s the total crypto market cap?

As of July 26, 2025, it’s $3.97 trillion, with Bitcoin at 59.2% dominance.

Is a higher market cap better?

Not always. Large-caps are stable but may grow slowly. Small-caps are volatile but have more growth potential.

How is market cap different from trading volume?

Market cap is total value (price × circulating supply). Trading volume is the amount traded over time, showing liquidity.

Conclusion

Market cap is a vital metric for understanding a cryptocurrency’s size, stability, and market position. It helps compare assets, assess risks, and build balanced portfolios. However, it’s not the whole story—combine it with research on technology, adoption, and market trends for smarter decisions. Track market caps on platforms like CoinMarketCap and dive into more crypto insights on Krypdrops.

Explore more: