Cryptocurrency markets are volatile, creating opportunities to profit from both rising and falling prices. Shorting crypto—betting on price drops—can be a powerful strategy for traders. But how does it work, and is it safe? This guide explains everything you need to know about shorting crypto in 2025, including methods, risks, and top platforms. Whether you’re a beginner or an experienced trader, we’ll break it down in simple terms to help you decide if shorting is right for you.

What is Shorting Crypto?

Shorting crypto means borrowing a cryptocurrency, like Bitcoin or Ethereum, and selling it at the current price. You aim to buy it back later at a lower price, return the borrowed amount, and keep the difference as profit. It’s a way to make money when prices fall, unlike buying and holding, which relies on price increases.

For example, if Bitcoin is $110,000 and you expect it to drop, you borrow and sell one Bitcoin. If the price falls to $100,000, you buy it back, return it, and pocket $10,000 (minus fees). However, if the price rises, you could lose money.

How It Differs from Stock Shorting

Shorting crypto is similar to shorting stocks but operates in a less regulated market. Crypto exchanges often simplify the process through built-in tools like margin trading or futures, making it more accessible but riskier due to rapid price swings.

Why Short Crypto?

Traders short crypto for several reasons:

- Profit in Bear Markets: When prices are expected to fall, shorting lets you earn from the decline.

- Hedge Investments: If you own crypto, shorting can protect against losses if prices drop.

- High Volatility: Crypto’s price swings, like Bitcoin’s 50% drops after 100% rallies, create shorting opportunities.

In July 2025, Bitcoin trades above $110,000, yet some traders are bearish, with short positions growing. However, predictions like Citigroup’s $135,000 Bitcoin target by year-end highlight the risks of shorting.

How to Short Crypto

You can short crypto using several methods, each with unique risks and requirements. Below are the main approaches and how they work.

Methods for Shorting Crypto

| Method | Description | Risk Level | Platforms |

|---|---|---|---|

| Margin Trading | Borrow crypto from an exchange, sell it, and buy it back at a lower price. | High | Binance, Kraken, Coinbase Pro |

| Futures Contracts | Agree to sell crypto at a set price on a future date, profiting if prices drop. | High | Kraken Futures, Binance, OKX |

| Options Trading | Use put options to sell crypto at a higher price if it falls. | Moderate-High | Binance, Deribit |

| Prediction Markets | Bet on price drops through speculative platforms. | Moderate | Polymarket, GnosisDAO |

| CFDs | Speculate on price differences without owning crypto (not available in the U.S.). | High | IG International, eToro |

| Inverse ETFs | Invest in funds that profit when crypto prices fall, like BITI. | Moderate | ProShares, U.S. stock exchanges |

- Margin Trading: You borrow crypto from an exchange, sell it, and repay later. Leverage (e.g., 10x) amplifies gains but also losses.

- Futures Contracts: You agree to sell crypto at a future price. If the market price drops below that, you profit.

- Options Trading: Buy put options to sell crypto at a set price, benefiting if prices fall below that level.

- Prediction Markets: Platforms like Polymarket let you bet on price drops, offering a simpler but less direct approach.

- Contracts for Difference (CFDs): Bet on price movements without owning crypto. Banned in the U.S. due to regulations.

- Inverse ETFs: Funds like ProShares’ BITI gain value when Bitcoin falls, ideal for traditional investors.

Step-by-Step Guide to Shorting Crypto

- Choose an Exchange: Pick a platform like Binance, Kraken, or Coinbase that supports your preferred method.

- Create an Account: Sign up and complete KYC verification.

- Deposit Funds: Add crypto or fiat to cover borrowing costs and collateral.

- Select the Crypto: Choose the cryptocurrency to short, like Bitcoin or Ethereum.

- Open a Short Position: Place a sell order through margin, futures, or options.

- Monitor Prices: Track market movements to decide when to close your position.

- Close the Position: Buy back the crypto to repay the loan and secure your profit or loss.

Risks of Shorting Crypto

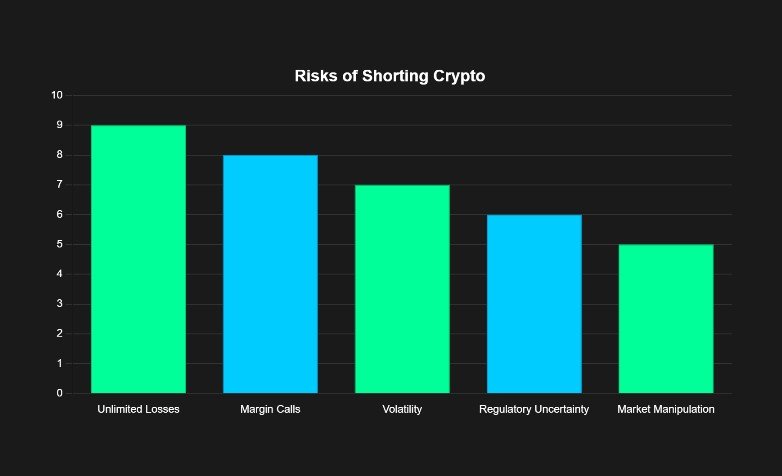

Shorting crypto is risky due to the market’s unpredictability. Here are the key risks:

- Unlimited Losses: If prices rise, losses can grow indefinitely. For example, shorting Bitcoin at $110,000 could lead to massive losses if it hits $135,000.

- Margin Calls: Exchanges may demand more funds if prices move against you, or they may liquidate your position.

- Volatility: Crypto prices can spike suddenly, wiping out short positions.

- Regulatory Risks: Unclear regulations can lead to platform restrictions or bans, especially for CFDs.

- Market Manipulation: Large traders or “whales” can trigger unexpected price jumps, hurting short sellers.

Best Platforms for Shorting Crypto in 2025

Here are top platforms for shorting crypto, based on features and availability:

| Platform | Features | Supported Methods | Availability |

|---|---|---|---|

| Binance | High leverage (up to 100x), margin, futures, options. | Margin, Futures, Options | Global (restrictions apply) |

| Kraken | Secure, supports margin and futures. | Margin, Futures | Global, including U.S. |

| Coinbase | User-friendly, margin via Coinbase Pro. | Margin | U.S. and select countries |

| Bybit | Focus on derivatives, perpetual futures. | Futures, Options | Global (restrictions apply) |

| OKX | Wide range of futures and options. | Futures, Options | Global (restrictions apply) |

Check fees, security, and regional restrictions before choosing. U.S. users face limits on CFDs due to SEC rules.

Tips for Successful Shorting

To improve your chances of success:

- Research Thoroughly: Use technical analysis (charts, indicators) and news to spot bearish trends.

- Use Stop-Loss Orders: Limit losses by setting automatic exit points.

- Start Small: Test strategies with low amounts to minimize risk.

- Stay Updated: Monitor regulatory changes and market events that affect prices.

- Diversify: Spread risk across multiple cryptocurrencies to avoid heavy losses.

Is Shorting Crypto Safe?

Shorting crypto is not safe for everyone. It’s an advanced strategy with high risks, including unlimited losses and margin calls. Beginners should practice with small positions and use risk management tools. Some also question its ethics, particularly in religious contexts. For example, certain Muslim scholars view shorting as gambling (haram) due to its speculative nature.

Frequently Asked Questions (FAQs)

Can you short crypto on Coinbase?

Yes, Coinbase Pro offers margin trading for shorting.

Is shorting crypto halal?

Opinions vary. Some scholars consider it haram due to speculation, while others may allow it under strict conditions. Consult a religious authority.

How to short crypto on Binance?

Enable margin trading or futures, deposit funds, and place a sell order to open a short position.

What’s the best way to short crypto?

Margin trading is simplest for beginners, while futures and options suit advanced traders.

Can you short crypto on Robinhood?

As of 2025, Robinhood does not support direct crypto shorting. Check for updates.

How to short crypto with leverage?

Use margin trading or futures on platforms like Binance or Bybit. Leverage increases both profits and risks.

Is shorting crypto legal?

Yes, in most countries, but regulations vary. CFDs are banned in the U.S..

Conclusion

Shorting crypto offers a way to profit from falling prices, but it’s not for everyone. With Bitcoin above $110,000 in July 2025 and bearish sentiment rising, opportunities exist for skilled traders. However, the risks—unlimited losses, volatility, and regulatory uncertainty—require caution. Choose a trusted platform, research thoroughly, and use risk management to stay safe. Ready to try? Start small and stay informed.

Explore more: