Cryptocurrency prices can swing wildly, making investing feel risky. Dollar-Cost Averaging (DCA) is a simple strategy that helps you invest in crypto with less worry. It lets you build your portfolio steadily over time, no matter if prices go up or down. This guide explains what DCA is, how it works, its benefits, and how to start using it for cryptocurrencies like Bitcoin or Ethereum.

What is Dollar-Cost Averaging (DCA)?

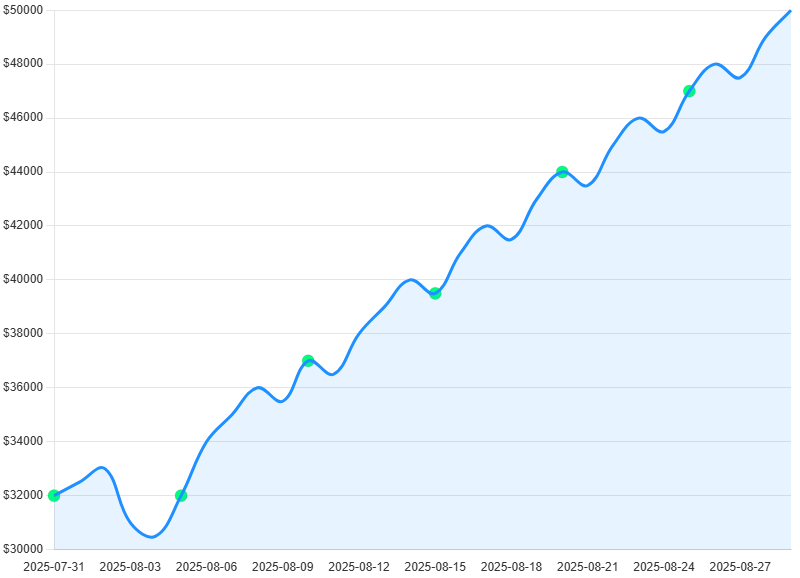

Dollar-Cost Averaging (DCA) is a method where you invest a fixed amount of money in an asset at regular intervals, regardless of its price. Instead of buying a large amount of crypto at once, you spread your investment over weeks, months, or years. This approach reduces the risk of buying at a high price and is popular in both stocks and crypto.

For example, if you have $1,200 to invest in Bitcoin, you might buy $100 worth every month for a year. This way, you purchase crypto at different prices, balancing out your overall cost.

How Does DCA Work in Crypto?

DCA involves investing the same amount of money at set intervals, like weekly or monthly. Here’s an example:

- Month 1: Bitcoin costs $50,000. You invest $100, buying 0.002 BTC.

- Month 2: Bitcoin drops to $40,000. Your $100 buys 0.0025 BTC.

- Month 3: Bitcoin rises to $60,000. Your $100 buys 0.00167 BTC.

After three months, you’ve spent $300 and own 0.00617 BTC. Your average cost per Bitcoin is about $48,622 ($300 ÷ 0.00617). This is lower than the peak price ($60,000) and higher than the low ($40,000). DCA helps you buy more when prices are low and less when prices are high, smoothing out market volatility.

Why Use DCA for Crypto?

Crypto markets are known for sharp price changes. DCA offers a way to invest without trying to predict the market. Here are the main benefits:

- Lowers Risk: Spreading investments over time reduces the chance of buying at a peak price.

- No Market Timing Needed: You don’t need to guess when prices will rise or fall.

- Supports Long-Term Goals: DCA is ideal if you believe crypto will grow over years.

- Reduces Emotional Stress: A fixed schedule prevents panic buying or selling during market swings.

Is DCA Right for You?

DCA suits many investors, but it’s not for everyone. Consider it if you:

- Are new to crypto and want a simple strategy.

- Plan to hold crypto for the long term.

- Prefer low-risk approaches over big, one-time investments.

DCA may not be ideal if:

- You have a large sum and think the market is at a low point. Lump-sum investing could give higher returns in a rising market.

- You want quick profits through active trading.

Always check your budget and risk tolerance. A financial advisor can help you decide if DCA fits your goals.

How to Start DCA in Crypto

Starting DCA is straightforward. Follow these steps:

- Pick a Platform: Use a trusted crypto exchange that supports recurring buys. Examples include:

- Set a Budget: Choose an amount you can afford, like $50 weekly or $100 monthly.

- Automate Purchases: Most platforms let you set up automatic buys for convenience.

- Stay Consistent: Stick to your plan, even if prices drop or rise.

- Review Periodically: Check your strategy yearly to ensure it matches your goals, but avoid reacting to short-term market changes.

For more on choosing platforms, read our article on How to Buy Crypto Without KYC.

DCA vs. Lump-Sum Investing

| Feature | DCA | Lump-Sum Investing |

|---|---|---|

| Definition | Invest fixed amounts regularly over time. | Invest a large amount all at once. |

| Risk | Lower, as it spreads out price exposure. | Higher, if the market drops after buying. |

| Returns | May miss some gains but protects against losses. | Higher in a rising market, but riskier. |

| Best For | Beginners, long-term, risk-averse investors. | Confident investors in a rising market. |

DCA is safer for volatile markets like crypto, while lump-sum investing might work better if you’re sure prices will rise soon.

Common Myths About DCA

- Myth 1: DCA Guarantees Profits. No strategy ensures gains. Crypto prices can fall, and you may lose money.

- Myth 2: DCA is Only for Crypto. You can use DCA for stocks, ETFs, or other assets.

- Myth 3: DCA is Hard to Set Up. Many exchanges make it easy with automatic buy options.

Tools and Platforms for DCA

Here are platforms and tools to simplify DCA:

- Coinbase: Offers recurring buys for easy automation.

- Kraken: Supports standing orders for regular purchases.

- Binance: Has a “DCA Bot” for automated investing.

- dcaBTC.com: A calculator to track Bitcoin DCA returns.

- Uphold: Provides a DCA Calculator for estimating gains.

Check fees when choosing a platform, as frequent buys can add up. For more on crypto fees, see Crypto.com Fees.

Risks and Downsides of DCA

DCA reduces risk but isn’t perfect. Consider these:

- Transaction Fees: Frequent buys may increase costs on some platforms.

- Missed Gains in Bull Markets: If prices rise steadily, lump-sum investing might outperform DCA.

- No Profit Guarantee: If crypto prices drop long-term, your investment could lose value.

Research your chosen crypto carefully. Focus on established assets like Bitcoin or Ethereum for safer DCA. Learn more in What is a Crypto ETF?.

Conclusion

Dollar-Cost Averaging is a smart way to invest in crypto without the stress of market timing. By investing a fixed amount regularly, you reduce risk and build your portfolio over time. It’s perfect for beginners and long-term investors who want a steady approach. Start small, choose a reliable platform, and stay consistent.

Ready to dive deeper? Explore these related posts: