Cryptocurrency exchanges are vital for buying, selling, and storing digital assets, but their safety is a major concern. Crypto.com, a leading platform, offers trading, staking, and a crypto debit card. With over 140 million users worldwide, it’s popular but not immune to risks. This guide examines Crypto.com’s security measures, user experiences, past incidents, and regulatory compliance to help you decide if it’s safe for you.

Since its launch in 2016, Crypto.com has become a go-to platform for crypto users. Its user-friendly app, cash-back rewards, and support for numerous cryptocurrencies make it appealing. However, with crypto scams and exchange hacks on the rise, safety is a critical question: Is Crypto.com safe?

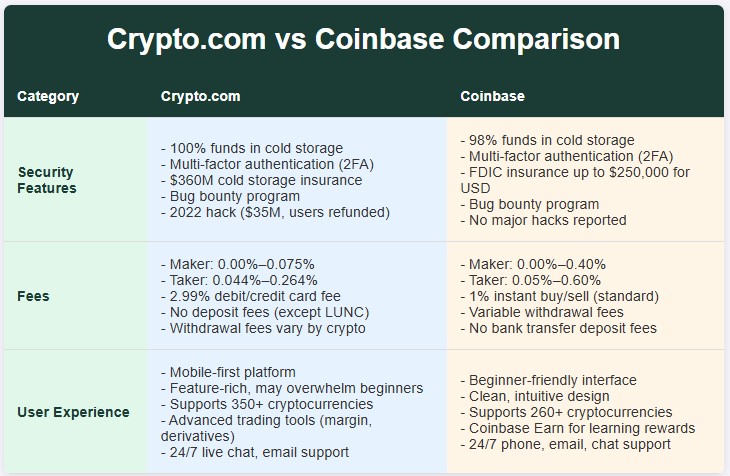

This post explores Crypto.com’s security features, user feedback, and potential risks. We’ll compare it to other exchanges like Coinbase and provide actionable tips to protect your funds. Whether you’re new to crypto or an experienced trader, this guide will help you make an informed choice.

Security Measures of Crypto.com

Crypto.com prioritizes security with a range of measures to safeguard user funds and data. Here’s a detailed look:

Asset Storage

- 100% Cold Storage: All user assets are stored in offline cold wallets, disconnected from the internet to prevent hacking.

- Proof of Reserves: Crypto.com publishes regular Proof of Reserves reports, verified by independent auditors like Mazars Group, ensuring assets are backed 1:1.

Account Security

- Multi-Factor Authentication (MFA): Users can enable MFA via authenticator apps, biometrics, or hardware security keys (FIDO2).

- Withdrawal Whitelisting: External addresses must be whitelisted via email verification, reducing unauthorized withdrawals.

- 24-Hour Withdrawal Delay: New withdrawal addresses face a 24-hour delay, allowing users to report suspicious activity.

- Anti-Phishing Code: Users can set a unique code to verify legitimate Crypto.com emails.

Certifications and Audits

Crypto.com holds industry-leading certifications, including:

- ISO 22301:2019 (Business Continuity Management)

- ISO/IEC 27701:2019 (Privacy Information Management)

- ISO/IEC 27001:2022 (Information Security Management)

- PCI DSS v4.0 Level 1 (Payment Card Industry Data Security Standard)

The platform is assessed at Tier 4 for NIST Cybersecurity and Privacy Frameworks and holds SOC 2 Type II compliance. Independent audits by firms like Kudelski Security ensure ongoing security. Crypto.com also runs a bug bounty program via Hacker One to reward vulnerability disclosures.

Insurance and Fiat Protection

- $750 Million Insurance Policy: Underwritten by Lloyd’s of London, it covers physical damage and third-party theft (but not user errors).

- FDIC Insurance for U.S. Users: USD balances are held in FDIC-insured accounts at Community Federal Savings Bank or other network banks, with coverage up to $250,000 per depositor.

| Security Feature | Details |

|---|---|

| Cold Storage | 100% of assets offline |

| Proof of Reserves | Regular audits by Mazars Group |

| MFA | Authenticator apps, biometrics, FIDO2 |

| Insurance | $750M for crypto, $250K FDIC for USD |

| Certifications | ISO 27001, PCI DSS, SOC 2 |

Learn more about withdrawing funds safely in our guide on How to Withdraw Money from Crypto.com.

Past Security Incidents

No crypto exchange is immune to threats. In January 2022, Crypto.com faced a hack where $33 million was stolen from 483 accounts. Fortunately, no user funds were lost due to cold storage. Crypto.com’s response included:

- Temporarily suspending withdrawals.

- Fully reimbursing affected users.

- Implementing new measures:

- 24-hour delay on withdrawal address changes.

- Revamped MFA system.

- Launch of the Worldwide Account Protection Program (WAPP).

This incident shows the risks of centralized exchanges but also Crypto.com’s commitment to user protection.

User Experiences and Reviews

User feedback provides insight into Crypto.com’s reliability. On Trustpilot, Crypto.com has a TrustScore of 1.5 out of 5 stars based on over 9,000 reviews, indicating mixed experiences.

Trustpilot Reviews

Common Issues:

- Account Access: Users report difficulties logging in, verifying accounts, or recovering access.

- Withdrawal Delays: Some face issues withdrawing funds, often due to compliance checks or technical glitches.

- Customer Service: Many complain about slow or unhelpful support, with unresolved issues.

- Financial Losses: A few users claim inability to access funds, raising concerns.

Positive Feedback:

- Some users praise quick refunds and coin recovery. For example, one user noted efficient support in recovering lost funds.

Comparison with Other Exchanges

Compared to Coinbase, Crypto.com offers similar security features, including MFA, cold storage, and insurance. Coinbase has a slightly higher user satisfaction rating and stronger U.S. regulatory compliance. Both are safe, but user experience and fees may influence your choice.

| Platform | Security Features | User Rating (Trustpilot) | Best For |

|---|---|---|---|

| Crypto.com | 100% cold storage, MFA, $750M insurance | 1.5/5 | Low fees, debit card |

| Coinbase | 98% cold storage, MFA, $250K FDIC | 2.0/5 | U.S. users, beginners |

Regulatory Compliance

Regulation ensures an exchange’s legitimacy. Crypto.com is regulated in multiple regions:

- U.S.: Holds a money services business license with FinCEN and money transmitter licenses in every state except New York.

- EU: Complies with MiCA regulations.

- U.K.: Operates under FCA’s AML rules.

- Canada: Registered with FINTRAC.

- Australia: Holds a Financial Services License.

Crypto.com enforces KYC and AML regulations, requiring identity verification. This reduces the risk of illegal activities but may cause delays for some users.

Note for U.S. Users: Crypto.com is legal in all states except New York. New Yorkers should consider Coinbase or other licensed platforms.

Curious about crypto’s broader impact? Check out Top Companies Accepting Cryptocurrency.

Risks and How to Mitigate Them

Even with strong security, risks persist. Here’s how to stay safe:

Common Risks

- Account Hacking: Phishing or weak passwords can lead to unauthorized access.

- Platform Failure: Centralized exchanges can face technical issues or bankruptcy.

- Scams: Fake apps or phishing sites can steal credentials.

Safety Tips

- Use Authenticator Apps: Avoid SMS-based 2FA; use Google Authenticator or Authy.

- Strong Passwords: Use complex passwords with letters, numbers, and symbols.

- Enable Anti-Phishing Code: Set this in Crypto.com’s settings to verify emails.

- Whitelist Addresses: Verify withdrawal addresses to prevent errors.

- External Wallets: Use hardware wallets like Ledger or Trezor for long-term storage.

| Risk | Mitigation |

|---|---|

| Hacking | Use MFA, strong passwords |

| Scams | Verify URLs, enable anti-phishing code |

| Platform Failure | Store large amounts in hardware wallets |

Is Crypto.com Safe for You?

Crypto.com’s safety depends on your needs:

- Beginners: Its intuitive app and educational resources make it beginner-friendly. Enable MFA and follow safety tips.

- Long-Term Storage: Cold storage is secure, but hardware wallets are safer for large amounts.

- Trading: Low fees and a wide range of assets suit active traders. Monitor your account regularly.

Explore crypto’s future with Will Crypto Recover?.

Alternatives and Considerations

If Crypto.com isn’t right for you, consider:

- Coinbase: Strong security and U.S. compliance, ideal for beginners.

- Binance: Wide asset range and low fees, but regulatory issues in some regions.

- Hardware Wallets: Ledger or Trezor for self-custody and maximum security.

Learn about wallet options in How to Buy Crypto with Tangem Wallet.

Conclusion

Crypto.com is among the safer crypto exchanges, with 100% cold storage, MFA, and a $750 million insurance policy. Its response to the 2022 hack and global regulatory compliance add credibility. However, mixed user reviews highlight issues with withdrawals and support, and no platform is risk-free.

For trading or short-term storage, Crypto.com is a solid choice. For long-term holding, transfer assets to a hardware wallet. Follow best practices like using authenticator apps and strong passwords to stay secure. Stay informed about crypto developments to protect your investments.