In cryptocurrency, CTO can mean Consumer Token Offering or Community Takeover, not just Chief Technology Officer. This guide explains both terms, their roles, and why they matter in the crypto world. Whether you’re a beginner or a seasoned crypto user, understanding CTOs helps you navigate this space with confidence.

What Does CTO Stand for in Crypto?

In crypto, CTO usually refers to Consumer Token Offering or Community Takeover. While Chief Technology Officer is a common business term, it’s less relevant here. This article focuses on the two crypto-specific meanings, breaking down how they work and their impact.

Understanding Consumer Token Offerings (CTOs)

A Consumer Token Offering (CTO) is a fundraising method where blockchain projects sell tokens to users. These tokens are used within the project’s ecosystem, like accessing services or products, not for investment. CTOs focus on utility and aim to avoid securities regulations.

Key Features of CTOs

- Utility-Driven: Tokens serve a purpose, like paying for services.

- Consumer-Focused: Targets users, not investors.

- Regulatory Approach: Designed to comply with laws by avoiding securities classification.

CTOs emerged around 2019, with projects like Civil (journalism platform) and FOAM (decentralized mapping) leading the way. The Brooklyn Project, supported by ConsenSys, created a framework to guide CTOs, ensuring tokens are utility-based.

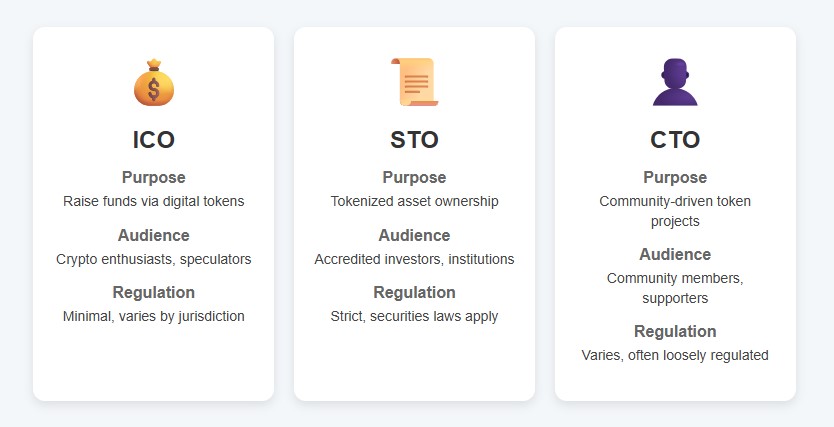

CTO vs. ICO vs. STO

Here’s how CTOs compare to other token offerings:

| Feature | ICO | STO | CTO |

|---|---|---|---|

| Purpose | Raise funds, often speculative | Represent asset ownership | Provide utility in ecosystem |

| Target Audience | Investors | Investors | Consumers |

| Regulation | Often unregulated | Follows securities laws | Avoids securities status |

| Example | 2017 ICO boom | Bitbond STO (2019) | Civil, FOAM |

- ICOs (Initial Coin Offerings): Popular in 2017, ICOs raised funds through speculative tokens, many facing regulatory issues.

- STOs (Security Token Offerings): Regulated tokens representing ownership, like shares.

- CTOs: Focus on user engagement, not investment.

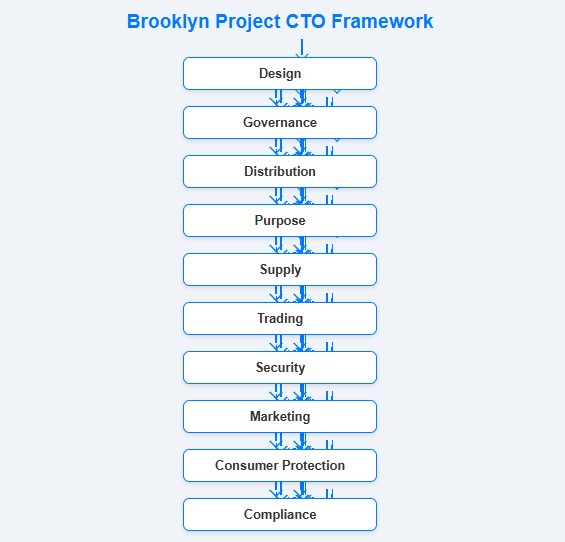

The Brooklyn Project Framework

The Brooklyn Project outlines steps for creating a CTO:

- Design: Define the token’s role.

- Governance: Set rules for the ecosystem.

- Distribution: Plan token allocation.

- Purpose: Clarify token utility.

- Supply: Decide total token amount.

- Trading: Address if tokens can be traded.

- Security: Ensure smart contract safety.

- Marketing: Promote to users.

- Consumer Protection: Safeguard users.

- Compliance: Follow legal guidelines.

This framework helps projects create compliant, user-focused tokens.

Benefits and Risks of CTOs

Benefits:

- Engages users with useful tokens.

- Simplifies regulatory compliance.

- Funds projects directly from consumers.

Risks:

- Users may not understand token value.

- Regulations are still unclear.

- Poor execution can harm projects.

Understanding Community Takeovers (CTOs)

A Community Takeover (CTO) happens when a crypto project’s community takes control after developers abandon it. Common in meme coins, this occurs after “rug pulls,” where creators take funds and leave. The community steps in to keep the project alive.

How Community Takeovers Work

- Abandonment: Developers stop supporting the project.

- Community Action: Token holders or enthusiasts take over.

- Governance: Often uses DAOs (Decentralized Autonomous Organizations) to manage.

Examples and Trends

In 2025, platforms like PumpFun introduced features for communities to share trading fee revenue after takeovers. However, some takeovers face fraud risks, with bad actors posing as community leaders.

Benefits and Risks of Community Takeovers

Benefits:

- Revives abandoned projects.

- Shows the power of decentralization.

Risks:

- Fraudulent takeovers (e.g., “Rug Pull 2.0”).

- Communities may lack technical skills.

- Legal issues around ownership.

Regulatory Landscape for CTOs

Both types of CTOs face regulatory challenges:

- Consumer Token Offerings: In the U.S., the Howey Test checks if tokens are securities. CTOs aim to fail this test by focusing on utility. In the EU, MiCA regulations guide utility tokens.

- Community Takeovers: Legal issues arise if original developers committed fraud. Communities may struggle with intellectual property rights.

Projects should consult legal experts to stay compliant.

Why CTOs Matter in Crypto

CTOs reflect crypto’s unique nature:

- Consumer Token Offerings show how projects can fundraise while engaging users.

- Community Takeovers highlight decentralization’s potential and risks.

Both concepts shape how crypto projects grow and survive in 2025.

FAQs

- Is a CTO the same as an ICO? No, CTOs focus on utility for consumers, while ICOs are often speculative and investment-focused.

- Are community takeovers safe? They can revive projects but risk fraud or mismanagement.

- How do I participate in a CTO? Check the project’s official site for token sale details and ensure it’s legitimate.

- What’s the future of CTOs in crypto? CTOs may grow as regulations clarify, and community takeovers could rely more on DAOs.

Conclusion

CTOs in crypto—whether Consumer Token Offerings or Community Takeovers—are key to understanding the industry. CTOs offer innovative ways to fund projects or revive abandoned ones, but they come with risks. Stay informed and cautious to make the most of these opportunities.

Explore more crypto topics on Krypdrops: