Cryptocurrency offers fast, secure, and often private transactions. But with freedom comes responsibility. Know Your Customer (KYC) is a key process in the crypto world. It ensures exchanges and users follow legal and ethical standards. This guide explains what KYC means in cryptocurrency, why it matters, how it works, and its impact on users and exchanges. Whether you’re new to crypto or a seasoned trader, understanding KYC is vital for navigating this space.

Understanding KYC in Crypto

What is KYC?

KYC, or Know Your Customer, is a process where financial institutions, including crypto exchanges, verify user identities. The goal is to prevent crimes like money laundering, fraud, and terrorist financing. In crypto, KYC is crucial because transactions can be pseudonymous, making them hard to trace without verification. Exchanges use KYC to ensure their platforms aren’t misused.

Why is KYC Necessary for Crypto Exchanges?

Crypto exchanges use KYC for several reasons:

- Regulatory Compliance: Many countries require KYC for financial institutions. In the U.S., the Bank Secrecy Act classifies crypto exchanges as money service businesses (MSBs), mandating KYC and Anti-Money Laundering (AML) measures.

- Preventing Financial Crimes: KYC helps stop illegal activities. A 2021 report estimated illicit crypto transactions at $14 billion, highlighting the need for KYC.

- Building Trust: Verifying identities creates a safer trading environment, fostering trust among users and regulators.

How Does KYC Work in Crypto?

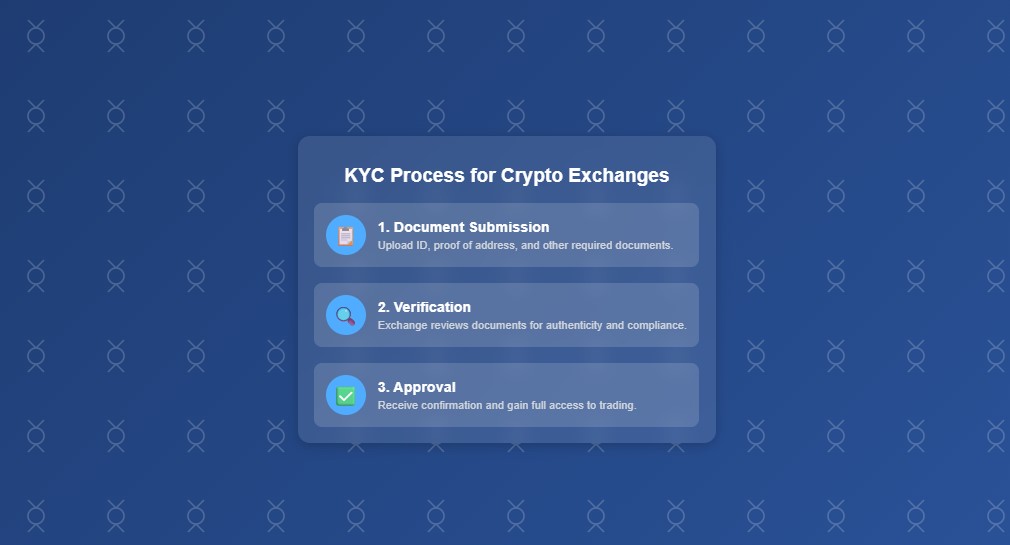

The KYC process in crypto includes these steps:

- Personal Information Collection: Users provide their full name, date of birth, address, and sometimes nationality or tax details.

- Document Submission: Users upload government-issued IDs (e.g., passport, driver’s license) and proof of address (e.g., utility bills).

- Biometric Verification: Some exchanges require a selfie or facial recognition to confirm identity.

- Risk Assessment: Exchanges check data against sanctions lists, politically exposed persons (PEPs), and adverse media.

- Approval: After verification, users gain full account access.

Automated systems often complete this process in minutes, ensuring quick and secure onboarding.

Benefits of KYC in Crypto

KYC offers several advantages:

- Enhanced Security: Identity verification reduces risks of hacking, theft, and fraud.

- Regulatory Compliance: Following KYC rules helps exchanges avoid penalties. In 2024, the UK’s Financial Conduct Authority fined Coinbase £3.5 million for AML violations.

- Trust and Transparency: KYC builds user confidence in a secure platform.

- Crime Prevention: It stops money laundering and terrorist financing, protecting the crypto ecosystem.

| Benefit | Description |

|---|---|

| Enhanced Security | Reduces risks of fraud, hacking, and theft by verifying user identities. |

| Regulatory Compliance | Ensures exchanges meet legal requirements, avoiding fines or closure. |

| Trust and Transparency | Builds user confidence in a secure and compliant platform. |

| Crime Prevention | Stops illegal activities like money laundering and terrorist financing. |

Challenges and Criticisms of KYC in Crypto

KYC faces some criticism:

- Privacy Concerns: Some users feel KYC undermines crypto’s anonymity. Reputable exchanges use encryption and comply with data protection laws like GDPR to address this.

- User Experience: The process can feel cumbersome, especially for beginners.

- Decentralization Debate: KYC clashes with crypto’s decentralized ethos, sparking debates about balancing regulation and innovation.

| Aspect | KYC | No KYC |

|---|---|---|

| Security | High; reduces fraud and theft risks | Lower; higher risk of illegal use |

| Privacy | Reduced; requires personal data | High; no personal data needed |

| User Experience | Can be cumbersome | Simpler, faster onboarding |

| Regulatory Compliance | Meets legal requirements | Risks fines or closure |

Is KYC Mandatory for Crypto Exchanges?

KYC is required for most centralized exchanges in regulated markets. For example:

- In the U.S., exchanges must comply with the Bank Secrecy Act.

- In the EU, the Anti-Money Laundering Directive (AMLD6) mandates KYC.

Decentralized exchanges (DEXs) like Uniswap don’t require KYC because they enable peer-to-peer trading without intermediaries. Some centralized exchanges offer limited services without KYC, but with restrictions on transaction amounts.

Alternatives to KYC in Crypto

Users can avoid KYC through these options, though they carry risks:

- Decentralized Exchanges (DEXs): Platforms like PancakeSwap allow trading without KYC, but they may have higher fees and less liquidity.

- Bitcoin ATMs: Some ATMs let users buy crypto with cash without KYC, but limits apply, and availability varies.

- Peer-to-Peer (P2P) Platforms: Sites like LocalBitcoins enable direct trading without KYC, but lack of oversight increases fraud risks.

Learn more about avoiding KYC in our guide on How to Buy Crypto Without KYC.

Frequently Asked Questions (FAQs)

Can you buy crypto without KYC?

Yes, through DEXs, bitcoin ATMs, or P2P platforms. These methods are riskier and may have higher fees or limits.

What documents are needed for KYC in crypto?

You’ll typically need a government-issued ID (e.g., passport, driver’s license), proof of address (e.g., utility bill), and sometimes a selfie.

How long does KYC verification take?

Verification usually takes minutes to hours, depending on the exchange and complexity of checks.

Is KYC the same as AML?

No. KYC verifies user identities, while AML includes broader measures to prevent money laundering. KYC is part of AML.

What are the risks of not having KYC?

Without KYC, exchanges face higher risks of money laundering, fraud, and regulatory penalties. Users may also encounter security issues.

Curious about crypto trading platforms? Check out Why Trade Crypto on eToro?.

Conclusion

KYC in crypto is a complex issue. It strengthens security and compliance but challenges the anonymity many crypto users value. As regulations evolve, balancing safety and innovation will shape the future of cryptocurrency. For now, KYC is a cornerstone of a trustworthy crypto ecosystem. Understanding its role helps users and exchanges navigate this fast-changing world.

Want to understand more crypto terms? Read our guide on Crypto Slippage Explained.