XRP is a cryptocurrency that powers the XRP Ledger (XRPL), a blockchain platform designed for fast and low-cost transactions. It’s often linked to Ripple, the company that developed it, but they are not the same. Launched in 2012, XRP is known for its speed, efficiency, and wide range of uses. This guide covers everything you need to know about XRP and XRPL, including their features, uses, legal status, and future potential.

What is the XRP Ledger (XRPL)?

The XRP Ledger is a decentralized, open-source blockchain technology. It supports real-time gross settlement, currency exchange, and remittance. Created by David Schwartz, Jed McCaleb, and Arthur Britto, XRPL is built for businesses and developers solving real-world problems.

Key Features of XRPL:

- Confirms transactions in 3-5 seconds.

- Requires no mining, using minimal energy.

- Aims for carbon neutrality by 2030.

- Offers low transaction fees, averaging $0.0002.

- Has over 10 years of error-free operation.

- Uses over 120 validators for decentralization, run by universities, exchanges, and individuals.

What is XRP?

XRP is the native cryptocurrency of the XRP Ledger. It’s used to pay transaction fees and can be held or traded on the network. A total of 100 billion XRP tokens were created at launch, with Ripple holding over 55% in escrow.

Uses of XRP:

- Enables fast, low-cost peer-to-peer payments.

- Acts as a bridge currency for cross-border transactions.

- Supports decentralized finance (DeFi) applications.

- Facilitates tokenization of real-world assets.

- Powers creation and trading of non-fungible tokens (NFTs).

How Does XRP Work?

XRP operates on the XRP Ledger, which uses a consensus protocol, not proof-of-work or proof-of-stake. Transactions are validated by over 150 validators, with 35+ on the Unique Node List (UNL). Ripple runs only one node, ensuring no single entity controls the network. Transactions are confirmed in 3-5 seconds, handling up to 1,500 transactions per second.

Is XRP Decentralized?

The XRP Ledger is decentralized, with over 120 validators operated by various entities. Ripple’s single node is a small fraction of the total, supporting decentralization claims. However, Ripple’s control of over 55% of XRP’s supply sparks centralization debates. Critics argue this gives Ripple influence, while supporters point to the validator network as evidence of decentralization.

Legal Status of XRP

In July 2023, a U.S. judge ruled that XRP itself is not a security, but some Ripple sales could be considered securities. The SEC sued Ripple in 2020, seeking a $2 billion fine in 2024. As of July 2025, an SEC appeal continues, creating uncertainty. Potential crypto-friendly U.S. policies, including new SEC leadership, may impact XRP’s future.

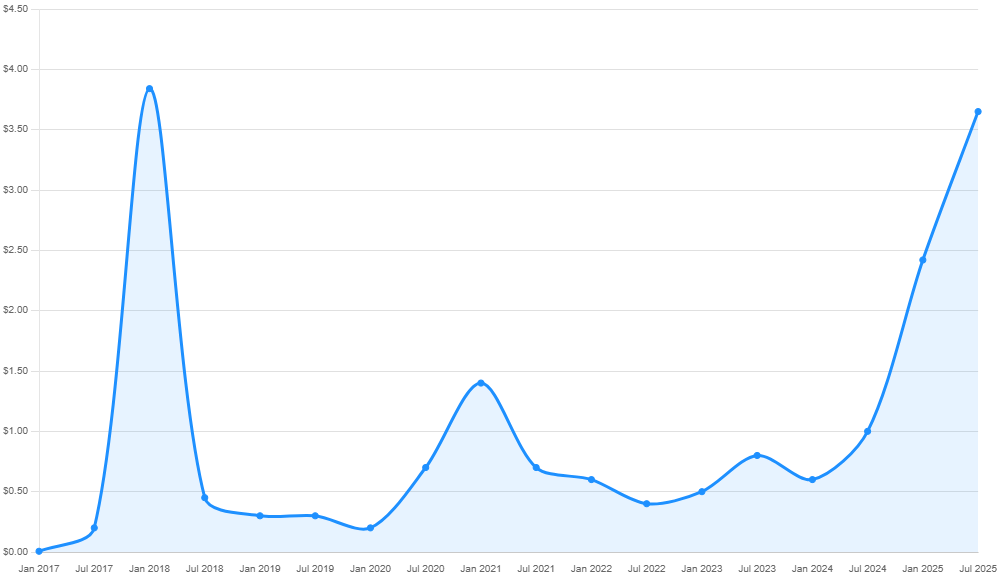

Price and Market Performance

As of July 30, 2025, XRP’s price is approximately $3.10, with a market cap over $180 billion, ranking it among top cryptocurrencies. XRP hit an all-time high of $3.40 in January 2025 but dropped 19% by July 29, 2025. Analysts predict potential rises to $6-$10 in 2025, though these are speculative.

Recent Price Movements:

- Reached $3.40 in January 2025.

- Declined to $3.10 by July 30, 2025.

- Gained 43% since July 2024.

- Whales opened $25M in long positions on July 30, 2025.

| Year | Price (USD) | Key Event |

|---|---|---|

| 2017 | 3.40 | All-time high |

| 2020 | 0.15 | Market low |

| 2024 | 0.38 | July low |

| 2025 | 3.10 | Current price (July 30, 2025) |

Use Cases of XRP

XRP’s speed and low fees make it versatile for multiple applications:

- Cross-Border Payments: Facilitates fast, low-cost international transfers, used by Santander and Standard Chartered.

- Liquidity Provision: Acts as a bridge currency in decentralized exchanges.

- Tokenization: Represents real-world assets on the blockchain.

- DeFi: Supports lending, borrowing, and financial services.

- NFTs: Enables creation and trading of unique digital assets.

How to Buy and Store XRP

To buy XRP, use exchanges like Binance, Coinbase, or Kraken. For storage, choose hardware wallets, software wallets, or the official Ripple wallet. Always check exchange security and compliance.

Related: How to Buy Crypto Without KYC

XRP vs Other Cryptocurrencies

| Cryptocurrency | Transaction Speed | Avg. Fee | Primary Use |

|---|---|---|---|

| XRP | 3-5 seconds | $0.0002 | Payments |

| Bitcoin | ~10 minutes | $1-10 | Store of value |

| Ethereum | ~15 seconds | $0.5-5 | Smart contracts |

- XRP vs Bitcoin: XRP is faster and cheaper, ideal for transactions. Bitcoin is slower and costlier but more established.

- XRP vs Ethereum: XRP focuses on payments, while Ethereum excels in smart contracts.

Related: Crypto Market Cap Explained

Future of XRP

XRP’s future looks promising with EVM-compatible sidechains and blockchain bridges. Ripple’s $1.25 billion acquisition of Hidden Road boosts its institutional focus. However, SEC lawsuits and market volatility pose risks. Investors should monitor regulatory changes.

Related: Will Crypto Recover?

Conclusion

XRP is a powerful cryptocurrency with fast transactions, low fees, and energy efficiency. Its uses in payments, DeFi, and NFTs make it a key blockchain player. Despite legal and market challenges, XRP’s potential remains strong. Stay informed about regulatory developments to understand its future.