Cryptocurrency offers new ways to invest and transact, but it comes with tax rules that can be confusing. A common question is: “Do you pay taxes on crypto before withdrawal?” The short answer is no—you don’t pay taxes just for holding or withdrawing crypto to your bank account. Taxes are due when you sell, trade, or use crypto, regardless of whether you withdraw it. This guide explains when taxes apply, how to calculate them, and how to stay compliant with IRS rules in 2025.

What Are Cryptocurrency Taxes?

The IRS treats cryptocurrency as property, not currency. This means any transaction that results in a gain or loss can be a taxable event. Holding crypto in your wallet doesn’t trigger taxes. Taxes apply only when you do something with your crypto, like selling or trading it.

Key Taxable Events

Here are the main actions that trigger taxes:

- Selling crypto: Converting crypto to fiat currency (e.g., USD).

- Trading crypto: Exchanging one crypto for another (e.g., Bitcoin for Ethereum).

- Using crypto: Paying for goods or services with crypto.

- Earning crypto: Receiving crypto as income, such as from mining or staking.

- Receiving airdrops or rewards: Getting free crypto from promotions or referrals.

If you transfer crypto between your own wallets, it’s not taxable. For more on withdrawing crypto, see our post on How to Withdraw Money from Crypto.com.

When Do You Pay Taxes on Crypto?

You don’t owe taxes just for holding crypto or withdrawing it to a bank account. Taxes are triggered by taxable events, which can happen before or after withdrawal. For example:

- If you sell Bitcoin for $20,000 that you bought for $15,000, you owe taxes on the $5,000 gain.

- If you trade Ethereum for Solana, the IRS treats it as selling Ethereum, which may result in a taxable gain.

- If you use crypto to buy a laptop, the IRS considers it a sale, and you owe taxes on any gain.

The key is the transaction, not the withdrawal.

How Are Crypto Taxes Calculated?

Crypto taxes are based on capital gains or losses. Here’s how to calculate them:

- Find your cost basis: This is what you paid for the crypto, including fees.

- Determine the sale price: This is the fair market value when you sell, trade, or use the crypto.

- Calculate the gain or loss: Subtract the cost basis from the sale price.

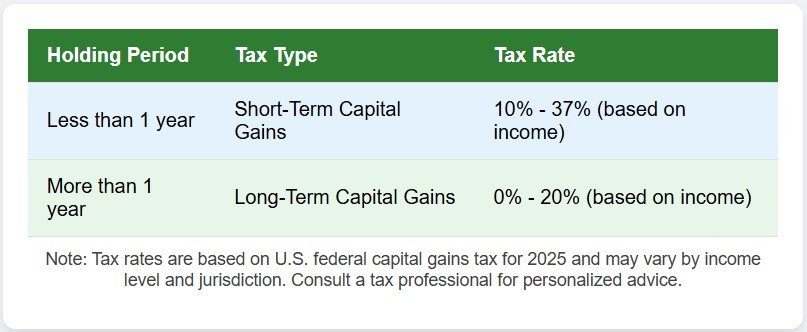

- Classify the gain:

- Short-term (held for one year or less): Taxed at ordinary income rates (10%–37%).

- Long-term (held for more than one year): Taxed at lower rates (0%, 15%, or 20%).

For example, if you bought 1 BTC for $10,000 and sold it for $12,000 after six months, you’d owe taxes on the $2,000 gain at your ordinary income tax rate.

Table: Crypto Tax Rates

| Holding Period | Tax Type | Tax Rate |

|---|---|---|

| 1 year or less | Ordinary Income | 10%–37% |

| More than 1 year | Capital Gains | 0%, 15%, or 20% |

Why Crypto Taxes Matter

The IRS is cracking down on crypto tax compliance. Starting in 2025, exchanges like聾like Coinbase will report gross proceeds from crypto sales on Form 1099-DA, making it easier for the IRS to track transactions. Failing to report taxable events can lead to penalties or audits. Keeping accurate records is critical to avoid issues.

How to Minimize Crypto Taxes

You can reduce your tax bill with these strategies:

- Hold for over a year: Long-term gains are taxed at lower rates.

- Use losses: Sell crypto at a loss to offset gains or deduct up to $3,000 against other income.

- Donate crypto: Donating to a qualified charity lets you deduct the fair market value without paying capital gains tax.

- Track transactions: Use crypto tax software to simplify reporting.

For more on converting crypto to cash, check out Can Crypto Be Turned into Real Money?.

How to Report Crypto Taxes

You report crypto taxes on:

- Form 8949: Lists all capital gains and losses.

- Schedule D: Summarizes Form 8949 for your Form 1040.

- Schedule 1 or C: Reports crypto income (e.g., from mining or staking).

Tips:

- Keep records of every transaction (dates, amounts, values).

- Use software like CoinLedger or Koinly to track transactions.

- Consult a tax professional for complex cases.

Learn more about trading platforms in Why Trade Crypto on eToro?.

FAQs: Common Crypto Tax Questions

Do I pay taxes on crypto if I don’t sell it?

No, holding crypto isn’t taxable. Taxes apply when you sell, trade, or use it. Income from mining or staking is taxable when received.

What if I trade one crypto for another?

Trading crypto is a taxable event. You calculate the gain based on the value of the crypto you traded away.

Can I deduct crypto losses?

Yes, losses can offset gains or up to $3,000 of other income, with excess carried forward.

What happens if I don’t report crypto taxes?

The IRS can track transactions via exchanges and blockchain analysis. Non-reporting may lead to penalties or audits.

Conclusion

You don’t pay taxes on crypto before withdrawal unless you’ve triggered a taxable event like selling or trading. By tracking transactions, using tax software, and planning strategically, you can stay compliant and minimize your tax bill. For the latest IRS guidance, visit IRS.gov.