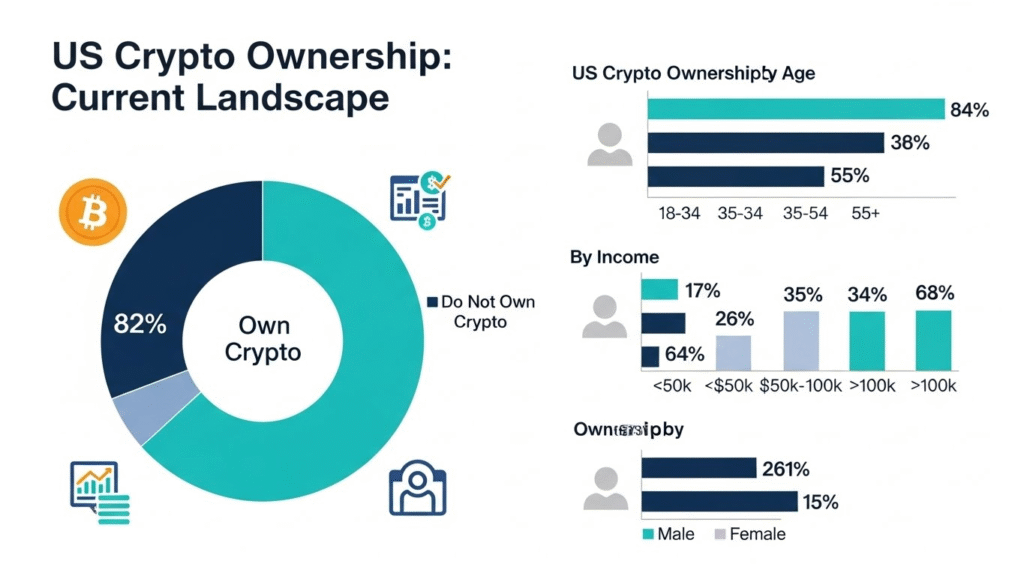

- Current data shows a range in crypto ownership among US adults in 2025, from 14% to 28%.

- This means between 46 million and 65 million people may own crypto now.

- Projections for 2026 vary due to market changes, but evidence points to possible growth to 20% or more.

- Factors like new rules and big investors could push numbers higher, though risks remain.

- Readers should note differences in surveys, as methods affect results.

Current Ownership Trends

Many sources report on crypto use in the US. In 2025, ownership stands at about 28% in some studies. Others show lower rates, like 14%. These numbers come from polls and reports. The gap may stem from how questions get asked or who responds.

Factors That Drive Growth

New laws help build trust. Big firms add funds to crypto. Stablecoins make use easier. These changes draw more people in. Yet, price swings and hacks hold some back.

What to Expect in 2026

Growth may slow or speed up based on the economy. Watch for more products like funds. If rules clear up, ownership could rise. Stay aware of risks before you buy.

Crypto ownership in the US has grown fast in recent years. People want to know what lies ahead for 2026. This report looks at data from top sources. It covers current numbers, future guesses, and reasons for change. You will find tables with clear stats. The goal is to help you see the full picture.

What Does Crypto Ownership Mean?

Crypto ownership counts people who hold digital assets like Bitcoin or Ethereum. Surveys ask if adults have any crypto. Some count only active users. Others include those who bought once. This leads to different totals. US adults number about 235 million. Percentages turn into big numbers fast.

Current Statistics on US Crypto Ownership

Data from 2025 shows a wide range. Here is a table of key estimates:

| Source | Year | Percentage of US Adults | Number of People | Notes |

|---|---|---|---|---|

| Gallup | 2025 | 14% | About 33 million | Based on adult poll. |

| Security.org | 2025 | 28% | 65.7 million | From consumer report. |

| Pew Research | 2024 | 17% | About 40 million | Ever invested or used. |

| Triple-A | Recent | 13.7% | 46 million | Current holders. |

| Coinbase | Recent | 20% | 52 million | Broad adoption. |

| Mastercard | 2025 | 28% | About 66 million | Swift adoption. |

| Yahoo Finance | 2025 | ~23% | 55 million | Investors noted. |

These numbers differ. Some surveys reach more people. Others focus on active use. The average falls around 20%, or 47 million. Growth from past years shows a rise. In 2021, rates were lower, like 15% in some reports.

Projections for Crypto Ownership in 2026

Few sources give exact numbers for 2026. One forecast from 2024 said 36.6 million US adults by 2026. This equals about 14% of adults. But 2025 data already tops that in some polls. If growth keeps up at 10-20% per year, numbers could hit 50-80 million. Global trends help guess. World users may reach 800-900 million by 2026. The US often leads, so rates here could climb to 25-30%.

Here is a table of possible scenarios:

| Scenario | Projected Percentage in 2026 | Projected Number | Basis |

|---|---|---|---|

| Low Growth | 15-20% | 35-47 million | Based on slow market, like older forecasts. |

| Medium Growth | 20-25% | 47-59 million | Matches recent trends from 2025 data. |

| High Growth | 25-30% | 59-70 million | If rules improve and prices rise. |

These are based on past patterns. Actual results depend on events.

Factors That Drive Growth

Several things push more Americans to own crypto.

- Rules and Laws: Clear rules build trust. In 2026, new laws may pass. This helps big investors join.

- Big Investors: Firms hold more Bitcoin. By 2026, they may own 20% of supply.

- Easy Use: Stablecoins grow fast. Their value rose 50% in 2025. Cards linked to wallets make spending simple.

- Money Worries: High debt makes people seek other stores of value. Bitcoin fits this role.

- Tech Advances: Better tools reduce barriers. More apps help new users start.

These factors could add millions more owners.

Challenges That Slow Adoption

Not all trends help growth.

- Price Swings: Crypto values change fast. This scares some away.

- Security Risks: Hacks and lost keys happen. About 20% of Bitcoin is lost.

- Lack of Knowledge: Many say they do not understand crypto. This blocks entry.

- Rule Uncertainty: Without clear laws, some wait. This holds back 2026 growth.

- Fees and Access: High costs in some areas limit use.

Address these to see higher ownership.

Who Owns Crypto? Demographics

Ownership varies by group. Younger adults lead. Those under 35 own more than older ones. Men hold more than women, but women rise fast. In 2024, 29% of women owned crypto, up from 18%. Income matters too. Higher earners join more. Cities show higher rates than rural areas.

Global Comparison

The US ranks high in ownership. Global rates sit at 11-12% by 2026. Countries like Turkey grow fast. Africa sees 19% rise in users. The US share of payments is 21%. This shows strong position.

What This Means for You

Higher ownership opens chances. If you own crypto, watch rules. New products may help. For new users, start small. Learn basics first. Use safe wallets. Track market news. Growth in 2026 could raise values, but plan for ups and downs.

Final Thoughts

Crypto ownership in the US keeps rising. By 2026, more people may join. Data shows promise, but caution is key. Stay informed to make good choices.