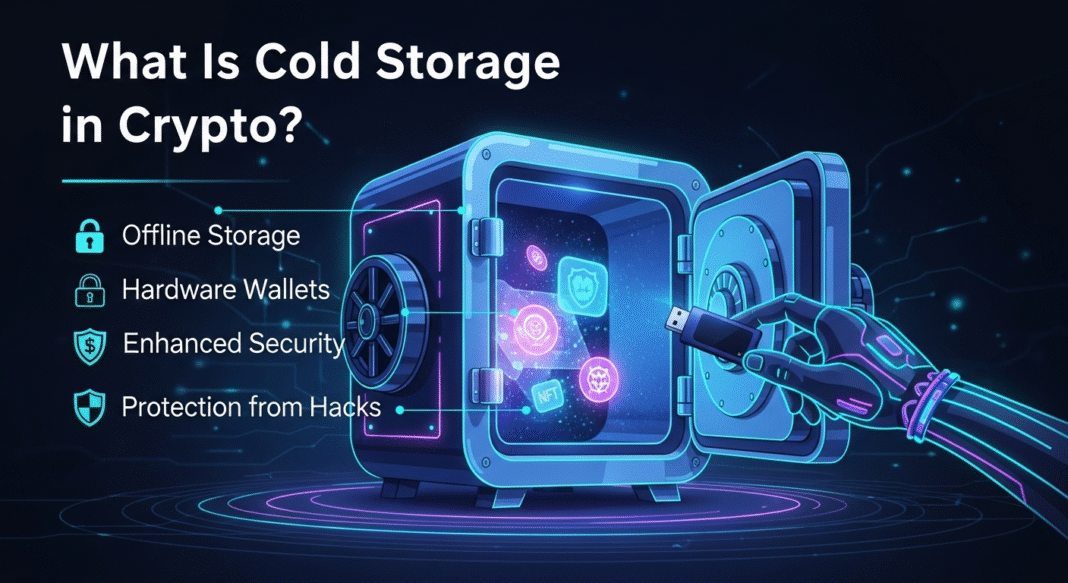

Cold storage keeps your crypto safe from online threats. It stores private keys offline. This method suits long-term holders. Research shows it reduces hack risks. Some users mix it with online options for balance.

Key Facts

- Cold storage means offline crypto wallets.

- It protects against hackers and malware.

- Common types include hardware and paper wallets.

- It offers high security but less ease for daily use.

- Many experts suggest it for large holdings.

Why Use Cold Storage?

You need cold storage to guard your assets. Online wallets face risks from attacks. Offline methods cut those risks. They keep keys away from the web. This way, only you can access funds.

Basic Differences

Cold storage differs from hot wallets. Hot wallets connect to the net. They allow quick trades. Cold ones stay offline. They focus on safety over speed.

Cold storage in crypto refers to methods that keep private keys offline. Private keys are codes that let you control your funds. By staying offline, these methods block online threats. This guide covers definitions, types, how it works, benefits, drawbacks, setup steps, and safety tips. It draws from top sources to give clear facts.

What Is Cold Storage?

Cold storage is a way to hold crypto without net access. It uses devices or materials not linked online. The goal is to shield keys from hacks. Unlike bank accounts, crypto has no central help if stolen. Once gone, funds stay lost. Cold storage helps prevent that.

Top sites define it as offline wallet use. For example, hardware devices store keys safely. Paper prints keys for physical keep. This method fits users who hold assets long-term.

How Does Cold Storage Work?

The process starts with key generation. You create keys on a safe device. Then move them offline. To receive crypto, share your public address. This address comes from public keys. It stays safe to share.

For sending, connect the cold device briefly. Sign the deal offline. Broadcast it via an online tool. Keys never touch the net. This keeps them secure.

Watch-only tools let you check balances. They use public keys only. No private key risk.

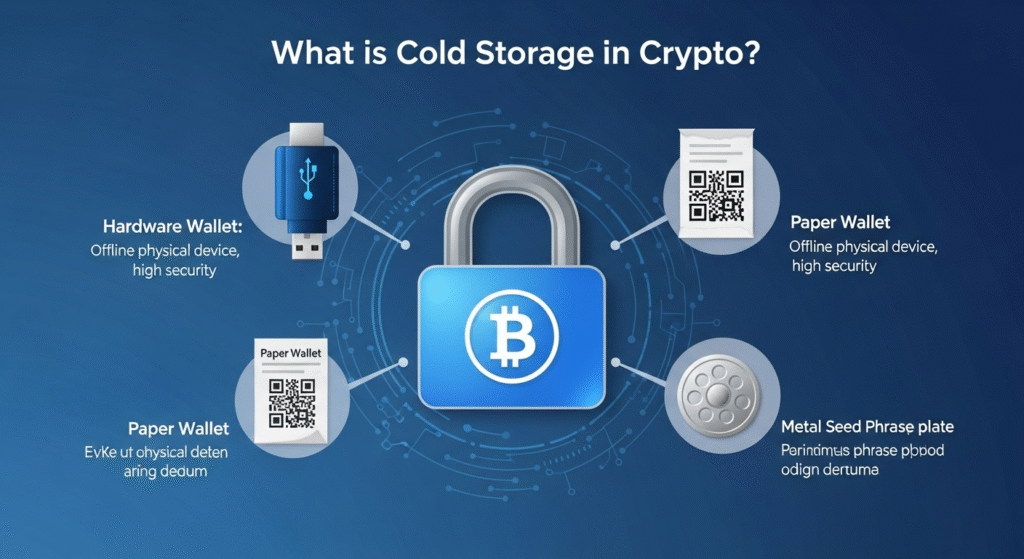

Types of Cold Storage

Several options exist. Each has unique features.

- Hardware Wallets: Small devices like USB sticks. They hold keys inside. Brands include Ledger and Trezor. Connect to computers for deals. Screens confirm actions.

- Paper Wallets: Print keys on paper. Include QR codes for scans. Keep in safe spots. Low cost but easy to damage.

- Offline Software Wallets: Run on devices never online. Use QR codes or files for transfers. Suits tech users.

- Metal Wallets: Engrave keys on metal plates. Resist fire and water. Good for backups.

- Air-Gapped Devices: Computers or phones cut from the net. High security for large sums.

- Mental Wallets: Memorize seed phrases. Use standards like BIP39. Risky if forgotten.

| Type | Description | Cost Range | Security Level |

|---|---|---|---|

| Hardware | Device-based key storage | $50-$150 | High |

| Paper | Printed keys and codes | Free | Medium |

| Offline Software | App on isolated device | Free | High |

| Metal | Engraved backups | $20-$100 | High (durable) |

| Air-Gapped | Fully offline machine | Varies | Very High |

| Mental | Memorized phrases | Free | Variable |

Pros and Cons of Cold Storage

Benefits and downsides help you decide.

Pros:

- Blocks online hacks.

- Controls your keys fully.

- Fits long holds.

- Resists malware.

- Some types last against damage.

Cons:

- Hard for quick deals.

- Risk of loss or harm.

- Setup needs care.

- No fast recovery if keys gone.

- Costs for some devices.

| Aspect | Pros | Cons |

|---|---|---|

| Security | Offline protection from threats | Physical risks like loss |

| Convenience | Good for storage | Slow for trades |

| Cost | Free options available | Devices add expense |

| Accessibility | Full user control | Needs backups |

Cold Storage vs. Hot Wallets

Hot wallets link to the net. They include apps on phones or computers. Easy for daily use. But open to attacks.

Cold storage stays offline. It guards against those attacks. Use hot for small sums. Keep most in cold.

| Feature | Cold Storage | Hot Wallets |

|---|---|---|

| Connection | Offline | Online |

| Security | High (no web risks) | Lower (hack vulnerable) |

| Use Case | Long-term hold | Daily trades |

| Speed | Slower | Faster |

| Examples | Hardware devices | Mobile apps |

Mix both for best results. Store bulk offline. Use online for spends.

How to Set Up Cold Storage

Follow these steps.

- Pick a type. Start with hardware for ease.

- Buy from trusted sources. Avoid fakes.

- Generate keys offline. Use the device guide.

- Write down seed phrase. This 12-24 word backup restores access.

- Store phrase safe. Split copies if needed.

- Test a small transfer. Check it works.

- Keep device secure. Use PINs and updates.

For paper: Generate keys offline. Print. Store in vault.

Ask: How do I recover if lost? Use seed phrase on new device.

How to Protect Your Cold Wallet

Safety matters most.

- Hide seed phrases well. Use safes or banks.

- Add passphrases for extra locks.

- Use multi-signature. Needs more than one key.

- Check for scams. Verify sources.

- Update firmware. Fix known issues.

- Test recovery. Practice often.

- Avoid sharing info. Keep private.

Common questions: Is cold storage safe from fire? Metal types yes. How to avoid loss? Make backups.

Final Thoughts

Cold storage gives strong protection for crypto. It suits those who value safety over speed. Choose based on your needs. Always back up keys. Stay informed on threats. This method helps secure assets in a risky space.