Understanding Fully Diluted Valuation (FDV)

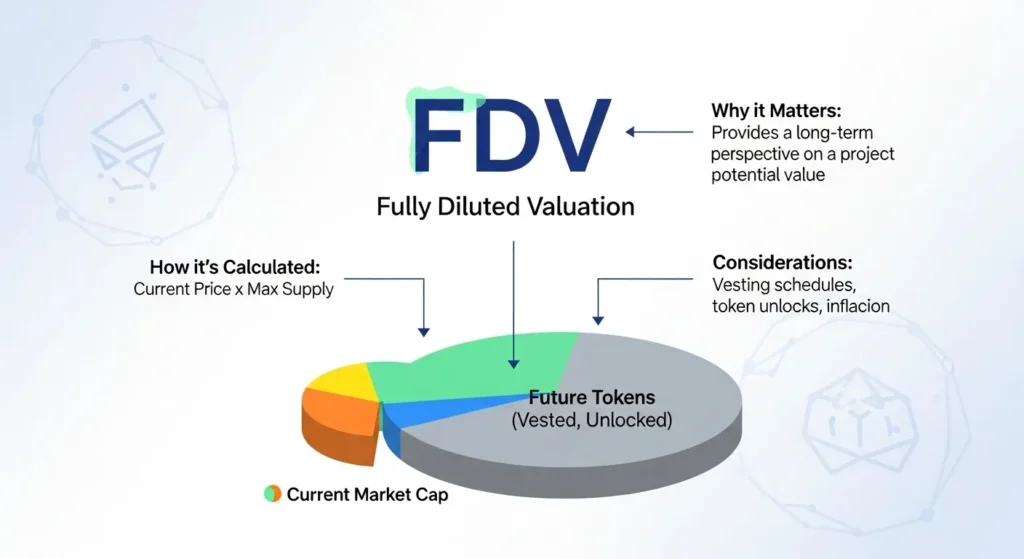

Fully Diluted Valuation (FDV) is a metric used to estimate the total market value of a cryptocurrency if all its tokens were in circulation CoinGeckoTangem. Think of it as seeing the complete picture of a crypto project’s worth.

In the cryptocurrency world, FDV is the total estimated value of a project if all of its tokens — currently available and those still not released — were sold on the open market What is a fully diluted valuation (FDV) in crypto?.

How FDV Works: The Simple Formula

FDV is calculated using the formula Token Price X Total Supply, which gives a projection of the cryptocurrency’s market cap when all tokens are in circulation The Market PeriodicalCoinDCX.

FDV Formula:

- FDV = Current Token Price × Total Supply

Real Example

For example, if a cryptocurrency has a current price of $10 and a max supply of 1 million tokens, the FDV would be $10 million.

Let’s say a token costs $2 with 1,000,000 total supply. Its circulating supply is only 500,000 tokens. While the market cap is $1,000,000 (500,000 tokens * $2), the FDV would be $2,000,000 (1,000,000 tokens * $2).

FDV vs Market Cap: Key Differences

Understanding the difference between FDV and market cap helps you make better investment decisions.

Market Cap

- Uses only circulating tokens

- Shows current market value

- Market cap reflects the present reality FDV vs Market Cap: Understanding the Key Differences – Quant Matter

FDV

- Uses total token supply

- Shows potential future value

- FDV provides a more comprehensive outlook for the potential future FDV vs Market Cap: Understanding the Key Differences – Quant Matter

For early-stage projects, FDV is often much higher than Market Cap due to the large number of locked or yet-to-be-released tokens. For established cryptocurrencies, FDV and Market Cap are often closer, as most tokens are already in circulation What Is Fully Diluted Market Cap & How To Use It- Phemex Academy.

Suggested Internal Link: Link to your article about “Market Cap in Crypto” if available

Why FDV Matters for Crypto Investors

1. Future Supply Impact

If FDV is much higher than the current Market Cap, it could mean that a lot of new tokens will eventually enter the market. And when supply goes up without matching demand, prices usually go down 42. Market Cap versus Fully Diluted Market Cap – the most important differences you should know! – Kanga University.

2. Investment Risk Assessment

However, if the FDV exceeds the current market capitalization, it may indicate that the project may ultimately be overvalued What Is FDV? Meaning, Formula, and Usage | Bitcoin.com.

3. Long-term Planning

Understanding FDV enables you to make better decisions by allowing you to see your investment’s total prospective value rather than its current value What Is FDV? Meaning, Formula, and Usage | Bitcoin.com.

When to Use FDV Analysis

For New Projects

FDV, however, may appeal to investors looking for high-growth opportunities, as it highlights the potential upside of a project if all tokens are eventually circulated What Is Fully Diluted Valuation (FDV) In Crypto.

For Established Coins

A higher Market Cap usually indicates a more mature and stable project with widespread acceptance What Is Fully Diluted Valuation (FDV) In Crypto.

Suggested External Link: Link to Coinbase’s educational resources about crypto valuation metrics

FDV Limitations You Should Know

1. Theoretical Nature

However, please remember that FDV is a hypothetical value, whereas market cap reflects the current total value of all circulating coins What Is FDV In Crypto And How To Calculate FDV – BullPerks.

2. Future Uncertainty

FDV offers valuable insights, it’s important to be aware of its limitations: Theoretical value: If every coin or token that might ever be created What Is FDV In Crypto And How To Calculate FDV – BullPerks reaches the market.

3. Token Burns and Changes

Some projects implement token burn mechanisms What Is Fully Diluted Market Cap & How To Use It- Phemex Academy, which can change the total supply over time.

How to Find FDV Information

You can find FDV data on major crypto tracking websites:

- CoinGecko

- CoinMarketCap

- Crypto.com

- Individual project websites

Red Flags to Watch For

Extremely High FDV Ratios

When FDV is 10x or more than market cap, be cautious. This means many tokens are still locked.

Unclear Token Release Schedule

Projects should clearly explain when and how new tokens enter circulation.

No Maximum Supply

Projects without a cap on total tokens can dilute value indefinitely.

FDV in Different Market Conditions

Bull Markets

FDV becomes less concerning as demand often absorbs new token releases.

Bear Markets

High FDV projects face more pressure as additional tokens enter weak markets.

Making Better Investment Decisions

Compare FDV Ratios

Look at similar projects and compare their FDV-to-market-cap ratios.

Check Release Schedules

Understand when locked tokens will enter circulation.

Consider Project Fundamentals

How much a cryptocurrency project’s token grows in value is the result of its technological and marketing progress What is Market Cap Vs Fully Diluted Market Cap.

Common FDV Mistakes

Ignoring Token Unlocks

Many investors forget about scheduled token releases that will increase supply.

Only Looking at Current Price

Price without context of future dilution can be misleading.

Comparing Different Token Models

Projects with different tokenomics shouldn’t be compared directly.

Final Thoughts

FDV gives you a complete picture of a crypto project’s potential value. While market cap shows current reality, FDV reveals future possibilities and risks.

Smart investors use both metrics together. High FDV isn’t automatically bad, but it requires careful analysis of token release schedules and project fundamentals.