Investing in cryptocurrency can be a great way to diversify your portfolio, but it’s not without risks. A common question is, “How much should I invest in crypto each month?” The answer depends on your finances, goals, and comfort with risk. This guide, based on expert insights and current trends as of August 2025, offers clear advice for beginners to invest wisely.

What Is Cryptocurrency?

Cryptocurrency is digital money secured by cryptography, running on blockchain technology. Bitcoin, launched in 2009, is the most well-known, followed by Ethereum, Ripple, and Solana. People invest in crypto for:

- High Returns: Bitcoin grew from $0.40 in 2010 to $111,000 in 2025, though past gains don’t guarantee future results .

- Diversification: Crypto moves differently from stocks or bonds, balancing your portfolio.

- Future Potential: Blockchain could shape finance and technology.

But crypto is volatile. Prices can drop 80% in months, like Bitcoin did in 2021 . Careful planning is key.

How Much Should You Invest?

Experts suggest putting 1-5% of your portfolio in crypto, with beginners starting at 1-2% to limit risk . Consider these factors:

- Age: Younger investors (20s-30s) can take more risk; older investors (40s+) may want less exposure.

- Goals: Are you aiming for long-term growth or short-term gains? Long-term goals allow more risk.

- Risk Comfort: Can you handle price swings of 30% or more? If not, invest less.

For example, if your portfolio is $10,000, 1-2% is $100-$200 in crypto. You could invest $50-$100 monthly to build this over time.

| Factor | Recommendation |

|---|---|

| Portfolio Allocation | 1-5% (1-2% for beginners) |

| Monthly Investment | $50-$100, based on income |

| Risk Tolerance | Only invest what you can afford to lose |

| Age Consideration | Younger: higher risk; Older: lower risk |

New to crypto? Read How to Start Investing in Cryptocurrency for beginner tips.

Best Investment Strategies

Dollar-Cost Averaging (DCA)

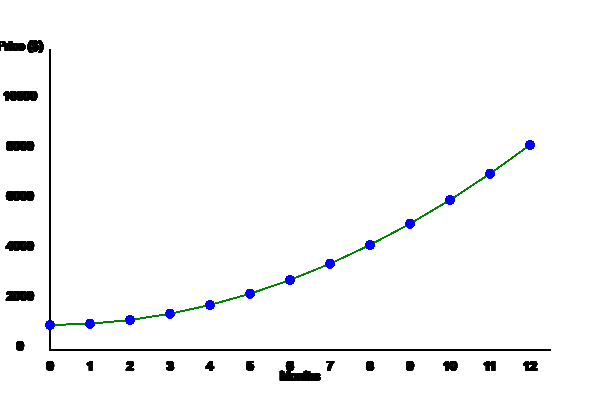

DCA means investing a fixed amount regularly, like $100 monthly, regardless of price . This reduces volatility’s impact by buying more when prices are low and less when high. For example, $100 weekly in Bitcoin from 2017 to 2021 grew from $16,300 to ~$65,000, a 299% return. Use platforms like Kraken to automate DCA.

Lump-Sum Investing

Buying during market dips can work but is riskier and needs market knowledge. DCA is safer for beginners.

Managing Risks

Crypto prices can be a rollercoaster. Bitcoin has lost 80% of its value in months . To stay safe:

- Invest Disposable Income: Have an emergency fund (3-6 months of expenses) before investing.

- Avoid Panic Selling: Stick to your plan during price drops.

- Use Trusted Exchanges: Platforms like Coinbase or Binance are secure.

Worried about market trends? Check Will Crypto Recover? for insights.

Diversifying Your Portfolio

Keep crypto as a small part of your investments, ideally below 5% . Spread your money across:

- Other Assets: Stocks, bonds, or ETFs.

- Multiple Cryptos: Consider Bitcoin, Ethereum, or stablecoins like Tether for balance.

Diversification lowers the risk of one coin crashing your portfolio.

Research Before Investing

Do your homework:

- Technology: Learn the coin’s blockchain and use cases (e.g., Ethereum’s smart contracts).

- Team: Check the project’s developers for credibility.

- Market Position: Stick to established coins like Bitcoin or Ethereum for safety .

- Community: Strong communities show support.

Want to pick the right coins? See What Is SUI Crypto? for an example.

Tax Considerations

Crypto gains may be taxed:

- Capital Gains Tax: Applies when you sell or trade for a profit.

- Income Tax: Applies to staking or mining earnings.

Use tools like CoinLedger for tax reports. Consult a tax professional for accuracy.

Learn more in Do You Pay Taxes on Crypto Before Withdrawal?.

FAQs

From Google’s “People Also Ask” and “Related Searches”:

Is crypto safe to invest in?

It’s safe if you invest small amounts, use trusted platforms, and diversify. Volatility makes it risky, so don’t overcommit.

What’s the best way to invest?

DCA is simple and reduces risk for beginners.

How much can I earn?

Returns vary. Bitcoin’s 299% ROI from 2017-2021 isn’t guaranteed.

Bitcoin or other cryptos?

Bitcoin and Ethereum are safer for beginners.

What is DCA?

Investing a fixed amount regularly to average costs.

How do I start?

Open an account on a trusted exchange, research, and invest small amounts monthly.

Conclusion

Crypto investing can be rewarding if done carefully. Start with 1-2% of your portfolio, around $100 monthly, using DCA. Manage risks, diversify, and research thoroughly. Consult a financial advisor for tailored advice. With discipline, you can build wealth while keeping risks low.