Aave is a decentralized finance (DeFi) platform that lets you lend and borrow cryptocurrencies without banks or middlemen. It uses smart contracts on the Ethereum blockchain to make transactions fast, transparent, and secure. Founded in 2017 by Stani Kulechov as ETHLend, it rebranded to Aave in 2018. The name “Aave,” meaning “ghost” in Finnish, reflects its decentralized nature. As of August 2025, Aave has over $15 billion in Total Value Locked (TVL), making it a top DeFi protocol.

This guide explains what Aave is, how it works, its features, benefits, risks, and how to get started. We’ll also cover its native token, AAVE, and compare it to other platforms.

What is Aave Crypto?

Aave is a DeFi protocol where users can lend cryptocurrencies to earn interest or borrow assets by providing collateral. It runs on smart contracts, which are self-executing programs that automate lending and borrowing. Unlike traditional banks, Aave doesn’t require credit checks or personal information, making it accessible globally. It supports over 20 cryptocurrencies, including Ethereum (ETH), USD Coin (USDC), and Dai (DAI).

The AAVE token is the platform’s native cryptocurrency. It’s used for governance, staking, and fee discounts. Holders can vote on Aave Improvement Proposals (AIPs) to shape the platform’s future, like adding new assets or changing rules.

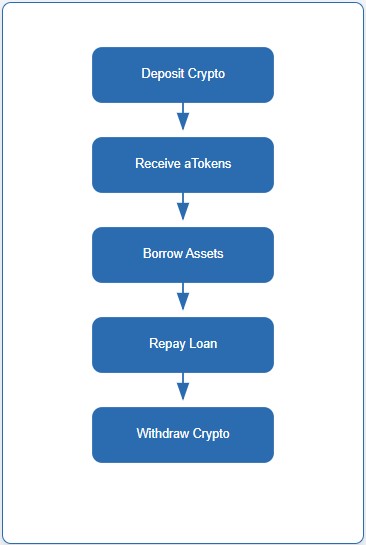

How Does Aave Work?

Aave operates through liquidity pools, where users deposit cryptocurrencies to lend or borrow. Here’s how it works:

- Lending: You deposit crypto into a liquidity pool. Other users borrow from this pool, and you earn interest based on demand.

- Borrowing: To borrow, you deposit collateral worth more than the loan. For example, to borrow $1,000 in ETH, you might need $1,500 in USDC. This is called overcollateralization.

- aTokens: When you deposit, you get aTokens (e.g., aETH for ETH), which represent your deposit and accrue interest.

- Interest Rates: Rates vary based on supply and demand. High demand for a coin increases rates for lenders.

- Liquidation: If your collateral’s value drops below the Loan-to-Value (LTV) ratio, it may be sold to repay the loan.

All transactions are transparent on the blockchain. Smart contracts handle everything automatically, reducing the need for intermediaries.

Key Features of Aave

Aave stands out in DeFi due to its unique features:

- Flash Loans: Borrow without collateral if repaid in the same transaction (13 seconds on Ethereum). Used for arbitrage or swapping collateral, with a 0.09% fee.

- aTokens: Represent your deposited assets and earn interest in real-time.

- Safety Module: Staking AAVE tokens helps cover liquidity shortages, earning stakers rewards.

- Governance: AAVE token holders vote on protocol changes, ensuring community control.

- Multi-Chain Support: Aave works on Ethereum, Polygon, Avalanche, and more.

- GHO Stablecoin: A decentralized stablecoin pegged to the US dollar, launched in 2022 for stable transactions.

Benefits of Using Aave

Aave offers several advantages:

- Earn Interest: Lenders earn competitive rates, often higher than bank savings accounts.

- Quick Loans: Borrowers get instant loans without paperwork, as long as collateral is provided.

- Transparency: All transactions are visible on the blockchain.

- Global Access: No KYC needed, making it open to anyone with a crypto wallet.

- Flexibility: Switch between fixed and variable interest rates to suit market conditions.

Risks of Using Aave

Despite its benefits, Aave has risks:

- Price Volatility: Crypto price drops can lead to collateral liquidation.

- Smart Contract Risks: Though audited, vulnerabilities could exist.

- Liquidation Penalties: Liquidated collateral incurs a fee, typically 5%.

- Regulatory Issues: No KYC may raise legal concerns in some countries.

Tip: Check your Health Factor on Aave to avoid liquidation. Keep it above 2 for safety.

How to Get Started with Aave

Follow these steps to use Aave:

- Set Up a Wallet: Use a wallet like MetaMask that supports Ethereum.

- Add Funds: Deposit crypto like ETH or USDC.

- Connect to Aave: Visit Aave’s website and connect your wallet.

- Lend or Borrow: Deposit assets to lend or use them as collateral to borrow.

- Monitor Your Position: Track interest rates and your Health Factor.

For more details, see Aave’s FAQ.

Aave vs. Other DeFi Platforms

Here’s how Aave compares to Compound and MakerDAO:

| Platform | Key Features | Unique Aspect |

|---|---|---|

| Aave | Flash loans, multi-chain | Instant uncollateralized loans |

| Compound | Lending pools, COMP token | Simpler rate model |

| MakerDAO | DAI stablecoin | Focus on stablecoin loans |

Aave’s flash loans and multi-chain support make it more versatile.

The Future of Aave

Aave is growing in 2025:

- New Networks: Aave V3 deployed on Aptos testnet.

- Centralized Lending: A proposal for Kraken’s Ink platform could blend DeFi and traditional finance.

- AAVE Price Outlook: Analysts predict AAVE could hit $356 by late 2025.

- Buyback Program: Aave’s DAO bought back 70,000 AAVE tokens in April 2025 for $15.7 million.

Conclusion

Aave is a powerful DeFi platform for lending and borrowing crypto. Its features like flash loans and governance make it a leader in the space. While it offers high returns and flexibility, risks like volatility and liquidation require caution. Start small, monitor your positions, and stay informed to use Aave effectively.

Visit more: